INTRODUCTION

In a diverse and rapidly developing country like India, ensuring financial security for its citizens is of paramount importance. To address the need for providing a pension to the vast working-class population, the Indian government introduced the Atal Pension Yojana (APY). This ambitious scheme, named after the former Prime Minister of India, Atal Bihari Vajpayee, was launched in June 2015 and is designed to offer a safety net for the elderly population, particularly those engaged in the unorganized sector. In this blog we’ll try to explore about, “Atal Pension Yojana”.

The Need for Atal Pension Yojana

The Atal Pension Yojana was launched with the recognition of a critical problem: the lack of access to a pension plan for a significant portion of the Indian workforce. The majority of workers in the unorganized sector, including laborers, maids, and daily wage earners, had little or no means of saving for their retirement. In a country where the joint family system is weakening, and social security for the elderly is becoming increasingly uncertain, this gap needed to be addressed.

KEY FEATURES OF ATAL PENSION YOJANA

Age Eligibility: APY is open to Indian citizens between the ages of 18 and 40 years. To avail the pension, one needs to start making contributions to the scheme.

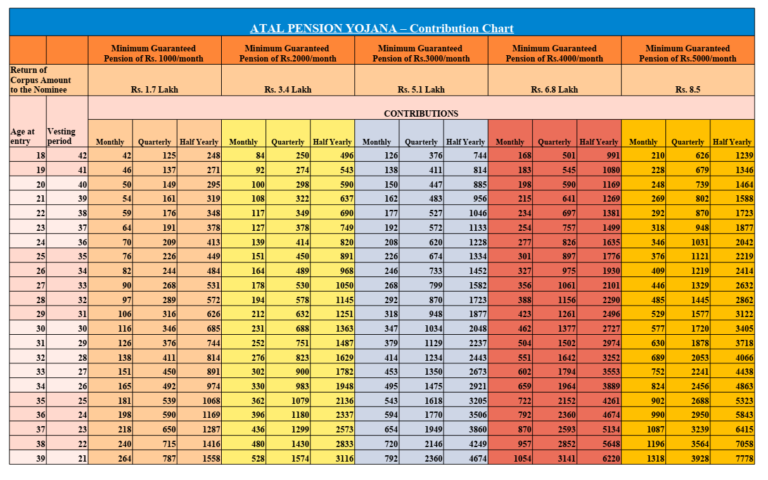

Monthly Contributions: The amount you contribute to APY depends on the pension amount you desire and the age at which you start contributing. The earlier you start, the lower the monthly contribution.

Pension Amounts: The scheme offers fixed pension amounts of Rs. 1,000, Rs. 2,000, Rs. 3,000, Rs. 4,000, or Rs. 5,000 per month. The pension is paid out after the beneficiary reaches the age of 60.

Guaranteed Returns: APY offers guaranteed returns, backed by the government. The pension amount is guaranteed for the spouse in case of the subscriber’s demise.

Voluntary Exit: Subscribers can exit the scheme before the age of 60, but only under certain conditions. Premature exits will result in reduced pension benefits.

Auto Debit Facility: The contributions are automatically debited from the subscriber’s bank account, making it a hassle-free process.

Government Co-Contribution: For eligible subscribers, the government provides a co-contribution for a specified period. This benefit primarily targets lower-income individuals.

BENEFITS OF ATAL PENSION YOJANA

Financial Security: APY aims to provide a stable and predictable income source for retirees, ensuring financial security during their post-working years.

Low-Cost Structure: The scheme is designed to be affordable, with contributions as low as Rs. 42 per month. This makes it accessible to a wide range of income groups.

Government Support: The government’s co-contribution and the guarantee of pension amounts provide an added layer of security.

Portability: The APY account is portable across the country, allowing subscribers to continue their contributions even if they relocate.

ELIGIBILITY FOR ATAL PENSION YOJANA

The government-backed social security scheme, Atal Pension Yojana offers individuals to build a retirement corpus wherein the government contributes 50% of the deposit for five years. This scheme provides benefit for nomination of a beneficiary. This beneficiary will receive the amount in case of the subscribers’ demise.

Requirements to open Atal Pension Yojana Account

- Must be an Indian Citizen.

- One within the age bracket of18 to 40 years, is authorized to open, only a single APY account.

- Minimum contribution period for the scheme is 20 years.

- Savings account with the authorized post office branch or banks is a must, linked with his/her Aadhaar.

- Appointing a nominee and to provide related details is mandatory for an individual who is applying for account.

Recent Government Notification on Atal Pension Yojana

Individuals who have been or who are currently a part of income tax regime are not entitled to subscribe for Atal Pension Yojana scheme. This is the recent change, as per the latest notification given by the Department of Financial Services.

Indian Central Government is not allowing income taxpayers from subscribing themselves for the APY effective from October 1, 2022, to ensure that this scheme benefits only the underprivileged.

The notification explains that – “From 1st October 2022, any citizen who is or has been an income-tax payer, shall not be eligible to join APY.”

Here attached a video for the ease of understanding:

Monthly Contribution for Atal Pension Yojana

Atal Pension Yojana monthly contributions solely rely on the preferred ultimate corpus amount and required monthly pension along with the individual’s age during the entry time into the scheme. The list of monthly contributions for Atal Pension Yojana is mentioned below in the table.

WITHDRAWL POLICIES

If any beneficiary has reached the age of 60 years, he/she is eligible to annuitise the complete corpus amount, i.e. he/she will receive a monthly pensions after closing the scheme with the related bank.

An individual who is a subscriber, can only exit the scheme prior to reaching the age of 60 under circumstances, like terminal illness or death.

In the case of a beneficiary’s demise, before he/she reaches the age of 60, his/her spouse shall be eligible to receive a pension. In such situation, the spouse has an option to either exit the scheme with the amount or he/she can continue to receive pension benefits.

If an individual chooses to take exit from the scheme before they reach the age of 60, they shall only be refunded their cumulative contributions and interest earned thereafter.

TERMS OF PENALTY

In case of any delay in the payment of contributions, following penalty charges shall be applicable –

Rs. 1 for monthly contributions of up to Rs. 100.

Rs. 2 for monthly contributions within Rs. 101 and Rs. 500.

Rs.5 for monthly contributions within Rs. 501 and Rs. 1000.

Rs.10 for monthly contributions of Rs. 1001 and above.

In the case of continued default in payment for 6 consecutive months, such account shall be frozen and if such default continues for 12 consecutive months, that account shall be deactivated and the amount thus accumulated along with interest would be returned to the respective individual.

TAX EXEMPTION

Tax exemption can be availed on contributions made by individuals towards Atal Pension Yojana, under Section 80CCD of the Income Tax Act, 1961. Under Section 80CCD (1), the maximum exemption allowed is 10% of the concerned individual’s gross total income up to a limit of Rs. 1,50,000. An additional exemption of Rs. 50,000 for contributions to the Atal Pension Yojana Scheme is allowed under Section 80CCD (1B).

Regardless, it is advisable to consult a professional for these exemptions as such tax benefits can be availed based on specific provisions stated in the Income Tax Act.

CONCLUSION

While Atal Pension Yojana has been a positive step towards ensuring financial security for India’s elderly population, it faces certain challenges. These include awareness and outreach, limited coverage in the unorganized sector, and the need for a higher contribution limit to cater to inflation and changing economic conditions.

To enhance the scheme’s effectiveness, the government can consider increasing the maximum monthly pension limit, expanding awareness campaigns, and increasing the coverage of the unorganized workforce.

In spite of above need of improvements, The Atal Pension Yojana is a noteworthy effort by the Indian government to address the retirement needs of its citizens. It provides an opportunity for millions of workers to secure their financial future in a convenient and cost-effective manner. With the right adjustments and continued efforts to reach those in need, APY can play a vital role in ensuring a dignified retirement for a substantial portion of India’s workforce.