HOW TO INVEST IN GOLD IN INDIA: INTRODUCTION

Gold has been a favored investment in India for centuries, revered for its cultural significance and perceived store of value. In recent times, there have been several avenues to invest in gold, catering to the diverse preferences and financial goals of investors. Gold has held a special place in the hearts and minds of Indians for centuries. It’s not just a precious metal; it’s a cultural icon, an auspicious symbol, and a symbol of wealth and security. In India, the appeal of gold as an investment goes far beyond its financial potential.

It’s a fact that from the start of civilization more than 200,000 tons of gold has been extracted. Out of that around 50% is distributed in form of jewelry instruments, 20% is there in form of coins, Gold ETF & Mutual funds, 18% is with Central Banks and rest of the residual amount is used (being used) in Real world applications.

Below mentioned are some off the benefits why one should consider Gold:

Cultural Significance: In India, gold is more than just an investment; it is deeply intertwined with the culture and traditions of the country. Gold jewelry is a common component of weddings and festivals, symbolizing prosperity and good fortune.

Wealth Preservation: Gold has historically proven to be a reliable store of value, protecting against inflation and economic uncertainties. During times of currency devaluation or economic instability, gold often retains or increases its value, making it a reliable hedge against financial crises.

Diversification: Gold, with its low correlation to other assets like stocks and bonds, serves as an effective diversification tool. When other investments falter, gold tends to perform well, balancing your portfolio and reducing overall risk.

Liquidity: Investing in gold in India is highly liquid. Gold jewelry can be quickly sold, and there is a well-established market for buying and selling gold. Additionally, financial products like Gold Exchange-Traded Funds (ETFs) and Sovereign Gold Bonds (SGBs) make it easy to trade gold on stock exchanges.

Capital Appreciation: Over the long term, gold has displayed a consistent trend of capital appreciation. While short-term price fluctuations are common, gold has demonstrated a steady growth in value. Investors in gold can benefit from price appreciation, especially in times of economic uncertainty or market volatility.

Tax Benefits: Sovereign Gold Bonds (SGBs) provide additional tax benefits for investors. Interest income from SGBs is exempt from income tax, and capital gains tax is also not applicable when the bonds are redeemed. This tax advantage can significantly enhance the returns on your gold investment.

Investment Options: India offers a wide range of investment options for those interested in gold. Investors can choose from physical gold, digital gold, Gold ETFs, Gold Mutual Funds, and Sovereign Gold Bonds, allowing for flexibility in terms of investment size, risk, and liquidity preferences.

WHY INVEST IN GOLD IN INDIA?

- One reason to invest in Gold is to give your portfolio adequate stability, as gold is considered to be an ideal hedge against devaluation done by inflation. Investments done in Gold, in most cases have given good returns over the past 40 years.

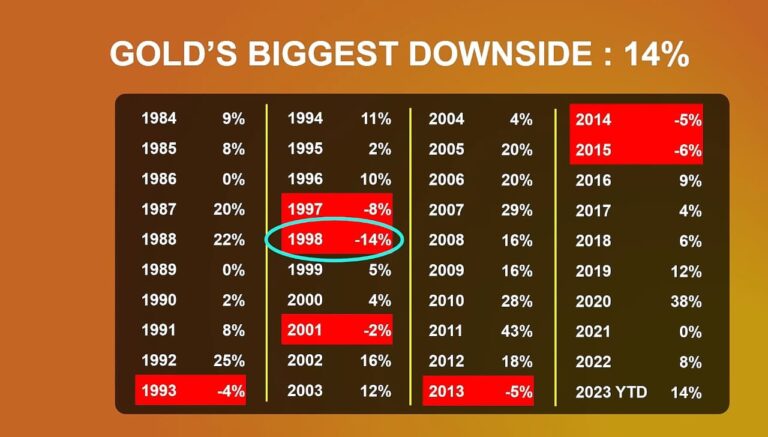

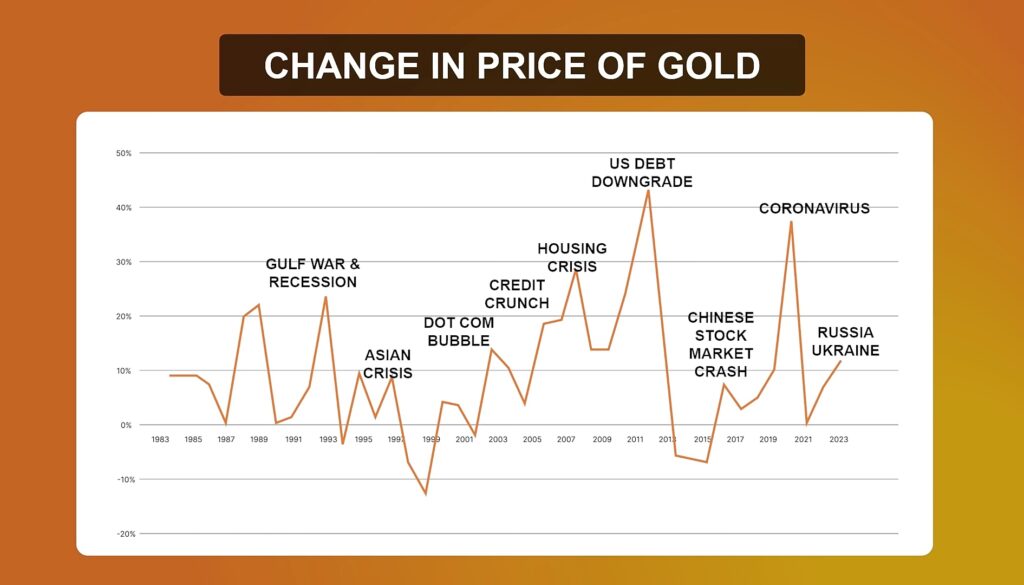

- Gold has on average provided annual returns of 9.2% over the past 40 years. For SIP, the returns could have resulted around 10.5%. It is also evident that during this period, only 7 episodes of negative annual returns were observed.

- Apart from the returns given, one more reason to use it as a hedge is because it has historically shown lower volatility in comparison to equity investments over long term. Surprising, in most of the cases, an inverse correlation to equities is observed, it means, Gold returns historically noted being high during the times, when equity markets have fallen.

- In the below graph, 1991-1993, 1999-2001, 2007-2010, and 2020 (periods when Gold showed superb performance). During these periods, Equity markets went in deep correction because of reasons such as the Indian Currency Crisis (1991-1993), Dot Com Bubble (1999-2001), Global Financial Crisis (2007-2010), and COVID-19 Pandemic (2020).

COMPARISON BETWEEN INVESTMENT OPTIONS TO INVEST IN GOLD IN INDIA

COMPARISON USING DIFFERENT PARAMETERS

Mainly there are five common methods to invest in gold in India: Physical gold, Digital gold, Gold Exchange-Traded Funds (ETFs), Gold Mutual Funds, and Sovereign Gold Bonds.

Physical Gold

Physical gold, such as jewelry, coins, or bars, is a traditional way to invest in gold. Below mentioned, are some important points:

Pros:

Tangibility: You can physically possess your investment.

Cultural significance: Gold jewelry can also serve ornamental and cultural purposes.

No management fees or brokerage charges.

Cons:

High storage costs and security concerns.

Limited liquidity when selling.

Lack of regular income or dividend.

Digital Gold

Digital gold platforms offer the convenience of buying and selling gold online. Investors purchase a fraction of physical gold, which is stored securely.

Pros:

Easy to buy and sell with just a few clicks.

Lower storage and security concerns.

Provides flexibility for smaller investments.

Cons:

Ownership of physical gold may not be in your name.

Limited choices for jewelry or ornamental gold.

Some platforms may charge fees.

Gold Exchange-Traded Funds (ETFs)

Gold ETFs are a kind of passive investment instrument that invest money in gold bullion and their returns are based on gold prices. In short, Gold ETFs are units representing physical gold which may be in paper or de-materialized form. These ETFs are traded and tracked in the way similar to shares, on stock exchanges.

Pros:

Easy liquidity as they are traded on stock exchanges.

No storage concerns as you don’t own physical gold.

Low expense ratios compared to mutual funds.

Cons:

Brokerage fees and demat account charges may apply.

Absence of physical ownership.

Potential tracking errors.

Gold Mutual Funds

Gold mutual funds invest in the shares of gold mining companies and other related assets (also in Gold ETF), providing indirect exposure to the gold market.

Pros:

Professional management and diversification.

Can generate dividends or capital gains.

No storage or security concerns.

Cons:

Performance is influenced by various factors, including company performance.

Expense ratios may be higher than Gold ETFs.

Limited correlation with the price of physical gold.

Sovereign Gold Bonds (SGBs)

Sovereign Gold Bonds are government-issued securities that offer returns linked to the price of gold. They also provide additional interest.

Pros:

No storage or security concerns.

Interest income on top of gold price appreciation.

Potential for capital gains and exemption from capital gains tax on maturity.

Cons:

Lock-in period (typically 5-8 years) with limited liquidity.

No physical ownership.

Interest rates are subject to change.

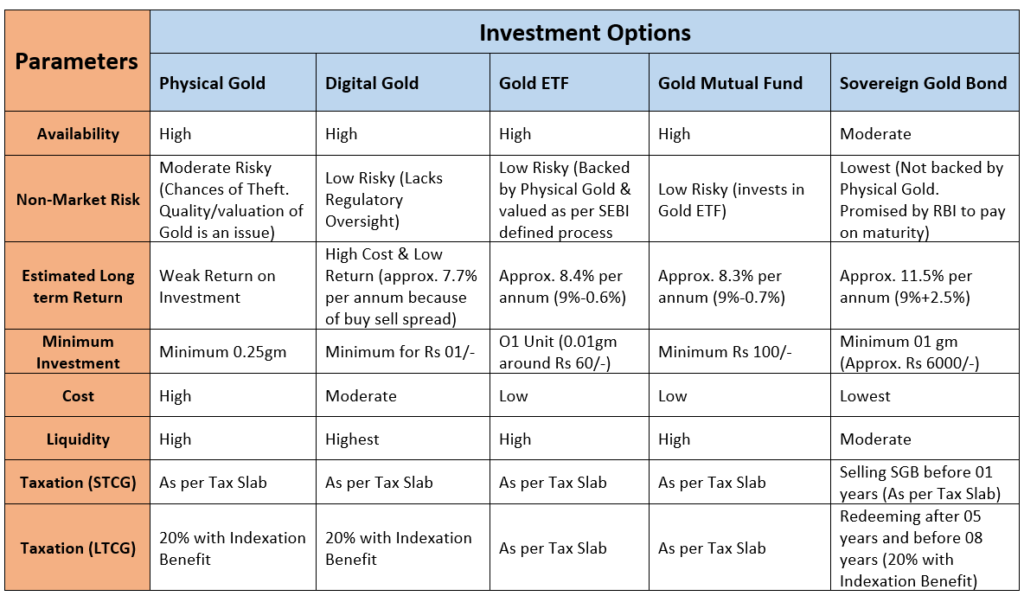

Further, in this blog we’ll compare these options on parameters such as, “Availability, Non-Market Risk, Minimum Investment option, Estimated Long Term Returns (Pretax), Costs, Liquidity & Taxation.

Availability:

All forms of gold are categorized as easily available, with Sovereign Gold Bond having moderate availability as RBI issue them in limited trenches.

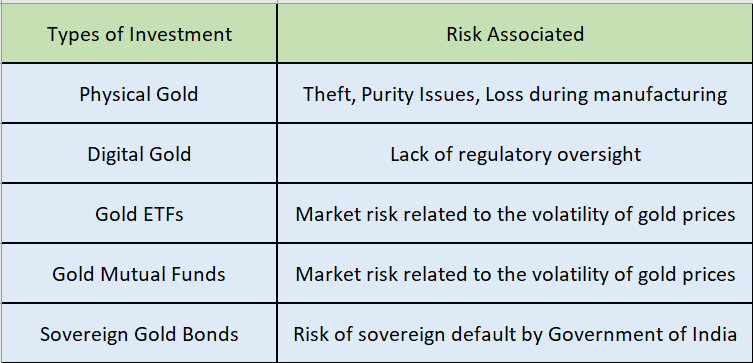

Non-Market Risk:

Below mentioned are the different investment options, and the risk associated with them:

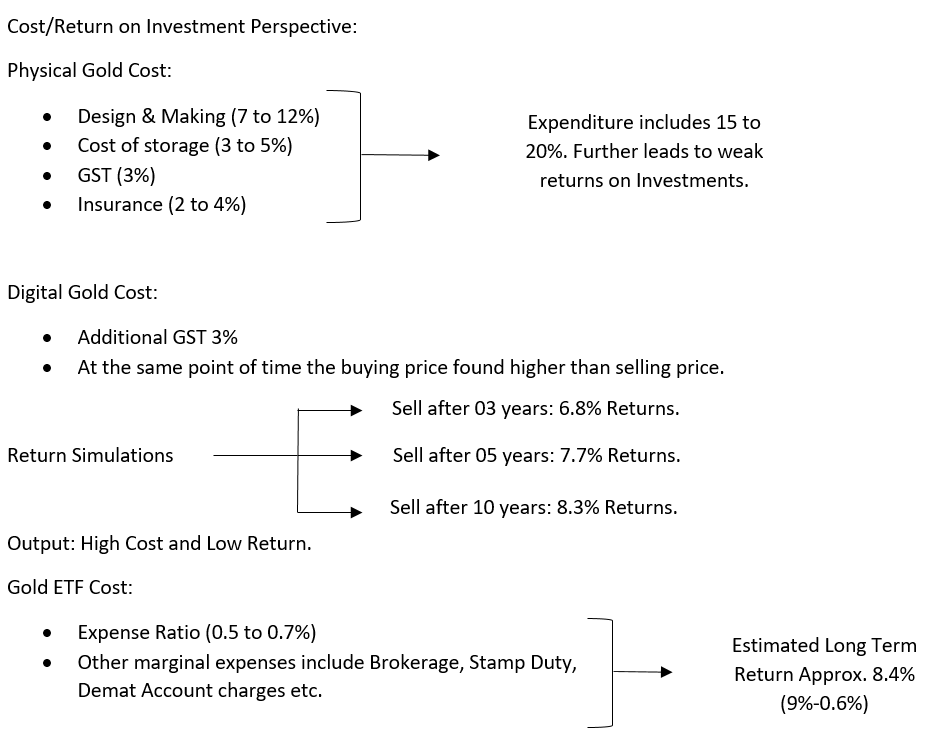

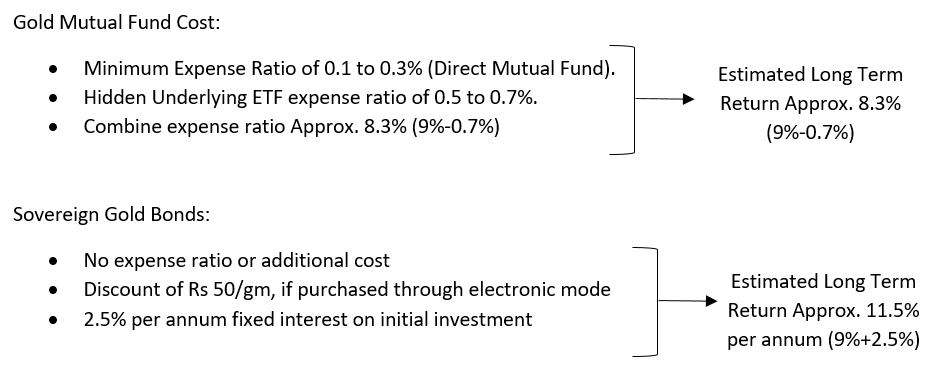

Cost/Return On Investment Perspective:

Liquidity:

Liquidity, here means the level of ease with which one can buy or sell gold through these options.

Options like Physical gold, digital gold, gold ETF, and gold mutual funds can be easily bought and sold. Therefore, they can be considered as liquid investments.

Sovereign gold bonds are issued with a maturity period of 8 years. However, in case you want to redeem before maturity, you have further 2 options.

You can prematurely redeem the bonds after 5 years, i.e., after completion of their lock-in period.

In case a person wants to redeem his/her invested amount before completion of 5-year period, he/she can do it by listing and selling this bond in the secondary market. This can be done after completion of 6 months from the date of issue.

Below is a video attached for reference purpose and for the ease of understanding:

CONCLUSION

To choose the right gold investment in India, you should consider your financial goals, risk tolerance, and convenience.

- If you value the cultural and aesthetic appeal of gold, physical gold or digital gold may be suitable for you. However, they are not highly recommended forms as they are not regulated by any government authority and they have significantly high buy-sell spreads.

- For short term, i.e., not more than 3 years and for the easy of liquidity and low-cost ownership, Gold ETFs can be a good option.

- If you prefer professional management and diversification, Gold Mutual Funds are worth exploring.

- Sovereign gold bonds are the most suitable choice if you plan to stay invested for an extended period (5+ years). Sovereign Gold Bonds combine the benefits of gold price appreciation with additional interest income & tax-free redemptions after staying invested for at least 5 years making them an excellent choice for long-term investors.

In the end, a well-diversified investment portfolio often includes a mix of these options, each serving a specific purpose. It’s crucial to consult with a financial advisor and carefully assess your financial situation before making any investment decisions. Keep in mind that the gold market, like any other investment, carries risks, and past performance is not indicative of future results.

At the same time, investing in gold in India is not just a financial decision; it’s a reflection of a rich cultural heritage and a commitment to financial security. Whether it’s for wealth preservation, diversification, or taking advantage of capital appreciation, gold holds a special place in the Indian investment landscape. However, like any investment, it’s important to approach gold investment with careful planning and a well-thought-out strategy. Consulting with a financial advisor and staying informed about market trends is crucial to making the most of your gold investment in India.