In recent years, the landscape of mutual fund Systematic Investment Plans (SIPs) in India has witnessed a significant evolution. With investors seeking more personalized and efficient investment avenues, Smart SIPs have positioned themselves as a contemporary solution, catering to the diverse needs of the investor community. In this blog, “SMART SIP: SIGNIFICANCE IN FINANCIAL LANDSCAPE” we’ll explore more about Smart SIP: it’s significance, advantages & disadvantages, unraveling their current standing and shedding light on the promising future prospects that lie ahead in the ever-evolving realm of financial investments.

SIP (Systematic Investment Plan)

Mutual Fund is an investment tool in which funds from investors are pooled and invested in equities, bonds, government securities, gold, and other assets. Companies that qualify to set up mutual funds, create Asset Management Company (AMC) or Fund Houses, which pool in the money from different investors, and invest in different asset classes. Mutual funds (with compounding benefit) provides money appreciation with inflation beating interest rates. SIP is highly effective and disciplined way of investing money consistently in Mutual Funds. This disciplined approach allows investors to benefit from the power of compounding and rupee cost averaging, mitigating the impact of market volatility.

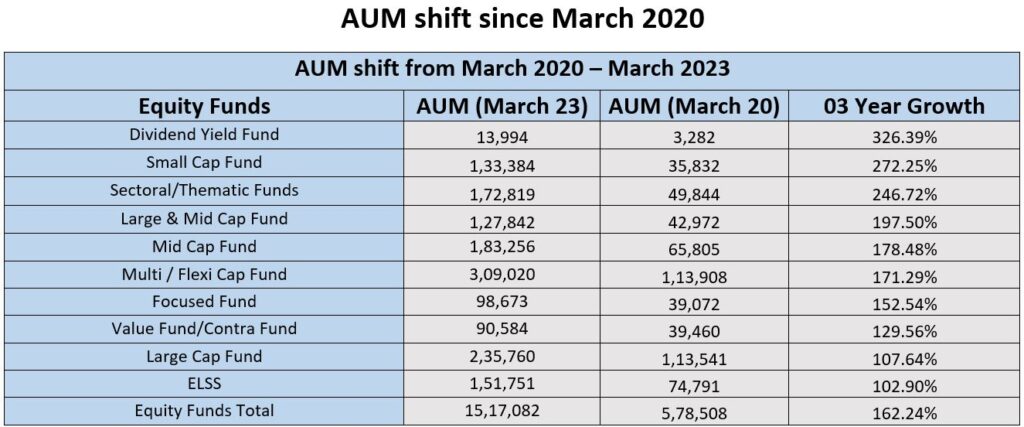

Post Covid pandemic, India has seen a significant increase in new Mutual fund SIP enrolments with government policies also supporting industrial growth. Between March 2020 and March2023, the Indian markets have seen a significant SIP growth with a 77% growth in mutual fund AUM. This growth is visible, with increase from a level of Rs22.26 trillion to Rs39.42 trillion. This can be largely attributed to a bounce in the markets but also substantially was accounted for by fresh flows into mutual funds through SIP.

Indian official data indicates, there are currently more than 7.44 crore SIP (Systematic Investment Plan) accounts for investing into various mutual fund schemes. SIP amount contribution seen an increase by nearly 25 percent (around ₹1.56 lakh crore) in 2022-23, against of that in 2021-22 (₹1.25 lakh crore). Also, April-November 2023, SIP contributions shown an increase of nearly 24% (at ₹1,24,313 crore), in comparison to that in April-November 2022 (₹1,00,581 crore).

In November 2023 alone, the mutual fund industry seen a record high increase in flows of nearly ₹17,073 crores through SIP. New SIPs registration observed around 30.80 lakh in comparison to 19.56 lakh in April 2023.

Understanding Smart/Power SIP

Smart/Power SIP is an evolution of the traditional SIP, integrating advanced features and strategies to enhance the investment experience. This innovative investment plan employs technology and data-driven insights to optimize investment decisions and potentially improve returns.

Key Features of Smart/Power SIP

Algorithmic Investing: Smart/Power SIP leverages algorithms and advanced analytics to make investment decisions. These algorithms analyze market trends, economic indicators, and historical data to make informed choices on asset allocation and timing of investments. This data-driven approach aims to capitalize on market opportunities and mitigate risks.

Dynamic Asset Allocation: Unlike traditional SIPs, which often follow a fixed asset allocation strategy, Smart/Power SIP dynamically adjusts its portfolio based on market conditions. This adaptability allows for a more responsive investment approach, optimizing the allocation to different asset classes based on their performance outlook.

Risk Management Strategies: Smart/Power SIP incorporates sophisticated risk management strategies to protect the portfolio from market downturns. This may include the use of stop-loss orders, derivatives, and other risk mitigation tools to limit potential losses.

Real-time Monitoring: One of the distinguishing features of Smart/Power SIP is the real-time monitoring of the portfolio. Investors can access updated information on their investments, market trends, and performance metrics, enabling them to make timely and informed decisions.

Differences from Traditional SIP

Active vs. Passive Management: Traditional SIPs typically follow a passive investment strategy, investing in a predefined portfolio with minimal adjustments. In contrast, Smart/Power SIPs actively manage portfolios through algorithmic trading, making real-time adjustments based on market conditions.

Technology Integration: Smart/Power SIP heavily relies on technology, utilizing artificial intelligence and data analytics to drive investment decisions. Traditional SIPs, on the other hand, may involve manual analysis and decision-making.

Flexibility and Adaptability: Traditional SIPs often follow a fixed investment pattern, while Smart/Power SIPs offer greater flexibility and adaptability. The ability to dynamically adjust to market changes sets Smart/Power SIPs apart, allowing for a more responsive and potentially optimized investment strategy.

Understanding the difference: Real Time Example

Consider a monthly SIP with an investment amount of Rs 1,000 in an equity mutual fund for three years, five years, and seven years with both traditional SIP option and option of smart SIP. While considering smart SIP, the PE value was mainly considered, and whenever the markets were found undervalued, the contribution for monthly SIP was doubled. By this way more number of units were purchased. On the other hand, in regular SIP option, investment was made in a uniform manner with same investment amount.

In SMART SIP, returns are calculated on the basis of PE valuations. It is considered that when the markets were overvalued, no investments were made. However, every mutual fund house could follow a different way of SMART SIP model.

The above table is for illustrative purpose only. (Source: PersonalFN Research, ACE MF)

Significance of Smart/Power SIP in India

In recent years, the Indian stock market has witnessed increased volatility, presenting both challenges and opportunities for investors. To navigate this dynamic landscape, investment strategies need to be adaptive and aligned with the financial goals of investors. One approach gaining prominence is the implementation of Smart SIP (Systematic Investment Plan) and Power SIP, providing investors with tools to address market uncertainties effectively.

Addressing the volatility in the Indian stock market: The Indian stock market is known for its fluctuations influenced by various factors, including global economic conditions, geopolitical events, and domestic economic indicators. Smart SIP and Power SIP aim to address this volatility by offering a systematic and disciplined approach to investing. Rather than attempting to time the market, these strategies focus on consistent and periodic investments, averaging the cost of acquisition over time.

Smart SIP: A Systematic Approach: Smart SIP involves leveraging technology and data analytics to optimize investment decisions. By employing algorithms and artificial intelligence, Smart SIP can analyze market trends, historical data, and economic indicators to make informed investment choices. This approach enables investors to adapt quickly to changing market conditions, reducing the impact of short-term fluctuations on their portfolios.

Power SIP: Enhancing Investment Potential: Power SIP takes the concept of SIP a step further by incorporating dynamic asset allocation strategies. This approach involves periodically rebalancing the investment portfolio based on market conditions and economic indicators. By doing so, Power SIP aims to enhance the potential returns of the investment while managing risk effectively. This adaptive strategy is well-suited for investors seeking a more dynamic and responsive approach to market changes.

Aligning with Financial Goals: One of the primary objectives of Smart SIP and Power SIP is to align with the financial goals of investors. These strategies are designed to cater to different risk profiles, investment horizons, and financial objectives. By setting clear financial goals, investors can tailor their SIP plans to meet their specific needs, whether it be wealth creation, retirement planning, or funding education.

Advantages & Disadvantages of Smart/Power SIP

Advantages

Increased Flexibility and Customization: Smart SIPs empower investors with a higher degree of flexibility and customization in their investment strategies. Traditional SIPs typically follow a fixed investment schedule, but Smart SIPs allow investors to tailor their plans according to changing market conditions, financial goals, and risk appetite. This adaptability ensures that the investment approach remains aligned with the investor’s objectives.

Harnessing the Power of Artificial Intelligence and Data Analytics: The integration of AI and data analytics is a game-changer in wealth management. Smart SIPs utilize these technologies to analyze vast amounts of financial data, identify patterns, and make data-driven investment decisions. This not only enhances the accuracy of investment choices but also enables the system to adapt to market trends in real-time, providing a proactive approach to portfolio management.

Mitigating Risks Through Dynamic Portfolio Adjustments: Smart SIPs employ algorithmic decision-making to continuously assess market risks and opportunities. This dynamic approach allows for real-time adjustments to the investment portfolio, helping to mitigate risks during volatile market conditions. By responding swiftly to changing market dynamics, Smart SIPs aim to optimize returns while minimizing potential losses.

Potential for Higher Returns Compared to Conventional SIPs: The application of advanced algorithms and predictive modeling in Smart SIPs aims to capitalize on market inefficiencies and identify lucrative investment opportunities. As a result, there is a potential for higher returns compared to traditional SIPs, which may follow a more static investment strategy. This makes Smart SIPs an attractive option for investors seeking to maximize their returns in a dynamic market environment.

Disadvantages and Challenges

Dependence on Technology and Data Accuracy: The success of Smart SIPs relies heavily on technology infrastructure and the accuracy of financial data. Any disruptions in technology or inaccuracies in data could lead to suboptimal investment decisions. Investors must be aware of the dependence on these technological components and ensure that they are robust and reliable.

Possible Complexities for Traditional Investors: The advanced nature of Smart SIPs may pose challenges for traditional investors who are accustomed to more straightforward investment approaches. Understanding the complexities of algorithms, data analytics, and AI-driven decision-making may require a learning curve for investors unfamiliar with these technologies. Proper education and guidance are essential to bridge this knowledge gap.

Risk of Over-Reliance on Algorithmic Decision-Making: While algorithms can analyze data and trends efficiently, over-reliance on algorithmic decision-making may pose risks. Market conditions can be influenced by unforeseen events or sudden shifts, and an entirely automated approach may not always account for these unpredictable factors. Striking the right balance between algorithmic decision-making and human oversight is crucial to manage this risk effectively.

Implementation and Adoption

Current Scenario of Smart SIP/Power SIP Adoption in India: The adoption of Smart SIPs in India is gaining momentum, driven by the increasing awareness of the benefits associated with these innovative investment strategies. Traditional SIPs operate on fixed investment amounts at regular intervals, providing a systematic way to accumulate wealth over time. In contrast, Smart SIPs utilize advanced algorithms and data analytics to dynamically adjust investment amounts based on market conditions, risk tolerance, and financial goals.

Investors are increasingly attracted to the flexibility and adaptability offered by Smart SIPs, allowing them to navigate volatile market conditions more effectively. Financial technology (fintech) firms and asset management companies are actively incorporating Smart SIP features into their offerings, catering to the evolving preferences of the Indian investor.

Insights into Financial Institutions’ Adoption: Financial institutions, including banks and asset management companies, are recognizing the potential of Smart SIPs to revolutionize the investment landscape. The use of artificial intelligence (AI) and machine learning (ML) algorithms allows these institutions to provide more personalized investment solutions, enhancing customer satisfaction and loyalty.

Moreover, financial institutions are leveraging technology to streamline the onboarding process for investors, making it more accessible and user-friendly. Mobile applications and online platforms have become essential tools for investors, offering real-time tracking, personalized recommendations, and interactive dashboards, making the investment experience seamless.

Investors are also benefiting from features such as goal-based investing, automated rebalancing, and risk profiling embedded in Smart SIPs. These advancements align with the growing trend of investors seeking holistic financial solutions that align with their individual goals and risk appetites.

Investors Embracing Innovation: Individual investors, too, are increasingly embracing Smart SIPs as they seek more control and customization in their investment portfolios. The ability to adapt investment amounts based on market conditions and personal circumstances resonates with investors looking for a dynamic and responsive investment approach.

The data-driven nature of Smart SIPs provides investors with valuable insights, empowering them to make informed decisions. The integration of technology and finance not only enhances convenience but also fosters financial literacy among investors, as they engage with intuitive interfaces and interactive tools.

Smart/Power Systematic Investment Plans have proven to be potent tools for investors seeking disciplined and strategic wealth creation. The success stories of Tesla and SoftBank highlight the potential for substantial returns, while challenges faced in renewable energy, cybersecurity, and AI integration underscore the importance of careful planning and adaptability. These real-life case studies offer valuable insights for both seasoned and aspiring investors navigating the ever-evolving landscape of smart and power investments.

Frequently Asked Questions

- What exactly is Smart SIP and how is it different from regular SIP?

In traditional/regular SIP a fixed amount of money is invested in equities every month regardless of the market valuation. However, this structure has its own limitation. You will be buying equities when the markets are very high. In Smart SIP, your funds will be invested in debt when markets are very high. Funds will be moved from debt to equity when market reaches to reasonable levels and vice-versa, (from equity to debt), depending on the market valuation. Hence, Smart SIP delivers considerably better returns, that too with lower risk. - Who decides market valuation and whether to invest in debt or equity?

PE (Price to Earning) ratio of index is the key indicator for market valuation. When market / index are showing PE higher its earnings, average returns of equities, are more likely to be lower than debt. Further,

equities are inherently risky. So, better to invest money into Debt instead of equity. When the PE ratio of index starts going on lower side and market goes under valuation, its the time to switch it back from the debt (low risk) to equity markets. - Does any AMC offer Smart SIP facility?

In India No existing AMCs are currently offering Smart SIP. This is an investment approach and is being followed by investor/broker. This concept can be used to make investment in any AMC.

References

Conclusion

Smart/Power SIPs represent a significant evolution in the world of investment, offering enhanced flexibility, data-driven decision-making, and the potential for higher returns. However, investors must be mindful of the challenges associated with technology dependence, the learning curve for traditional investors, and the risk of over-reliance on algorithms. Striking the right balance between technological innovation and human oversight is the key to navigate the future landscape of wealth management successfully.

This blog, “SMART SIP: SIGNIFICANCE IN FINANCIAL LANDSCAPE” outline aims to provide a comprehensive understanding of Smart/Power SIP, emphasizing its significance and impact on the Indian financial landscape. It will cover the advantages, disadvantages, and current trends, offering readers valuable insights into this evolving investment strategy.