What Are Flexi Cap Funds

The mutual fund landscape in India offers a wide variety of options to cater to different investor needs. Investing in mutual fund is a good way to get exposure of stock market in order to generate inflation beating returns, getting benefited by expertise of associated Fund Managers. Among the popular choices is the Flexi Cap Mutual Fund, a category that has gained significant attention due to its adaptability and potential for long-term wealth creation. In this blog, “WHAT ARE FLEXI CAP FUNDS: TOP 05 FLEXI CAP FUNDS IN 2024” we’ll delve into what Flexi Cap Mutual Funds are, how they work, key benefits of investing in them and best options available.

Understanding Flexi-Cap Funds

Flexi Cap Mutual Funds are a type of equity mutual fund that invests across companies of different market capitalizations. Unlike Large Cap, Mid Cap, or Small Cap funds that are restricted to a particular market segment, Flexi Cap funds have the flexibility to invest in large-cap, mid-cap, and small-cap stocks without any predefined allocation. This flexibility allows fund managers to adjust the portfolio based on market conditions, company performance, and growth potential.

The Securities and Exchange Board of India (SEBI) introduced the Flexi-cap mutual fund category in a circular dated November 6, 2020. This category requires that at least 65% of the total assets of a Flexi-cap fund be invested in equity and equity-related instruments.

How Do Flexi Cap Mutual Funds Work

The key feature of Flexi Cap funds is the fund manager’s ability to make decisions based on the current market situation. For instance, if large-cap stocks are performing well and seem stable, the fund manager may allocate more assets toward these stocks. On the other hand, if mid-cap or small-cap stocks show greater growth potential, the fund manager has the liberty to shift investments accordingly.

Key Benefits of Investing in Flexi Cap Mutual Funds

- Diversification: One of the biggest advantages of Flexi Cap Mutual Funds is diversification. By investing in companies across large, mid, and small caps, investors can enjoy the stability of large-cap companies while benefiting from the high-growth potential of mid and small-cap firms. This diversification helps mitigate risks as market conditions change. This is crucial in managing volatility and providing stability to the overall portfolio.

- Risk-Return Tradeoff: Flexi-Cap Funds maintains a balanced relation between risk and return. Large-cap stocks offer stability and lower risk, while mid-cap and small-cap stocks have the potential for higher returns but come with increased volatility. The fund manager’s experience and mastery in allocating assets across these segments is pivotal in maximizing the risk-return tradeoff.

- Professional Fund Management: Flexi Cap Mutual Funds are actively managed by professional fund managers who possess deep market knowledge. These experts analyze various sectors and companies to allocate funds where they see the best opportunity. Investors benefit from the expertise of professionals who understand market cycles and can adjust the portfolio accordingly.

- Tactical Allocation Based on Market Cycles: Flexi-Cap Funds showcase adaptability to changing market conditions. During periods of bullish trends, the fund can shift towards mid and small-cap stocks to make higher returns. Similarly, during market corrections or period of uncertainties, the fund manager may shift allocation towards large-cap stocks to attain stability. This dynamic approach enhances the fund’s resilience across market cycles.

- Potential for Long-Term Wealth Creation: Flexi Cap Mutual Funds are suitable for long-term investors looking for wealth creation. By having exposure to a mix of large, mid, and small caps, these funds allow investors to benefit from a balanced portfolio that provides growth potential while offering stability. Over the long term, this diversified approach can help generate substantial returns.

- Risk Mitigation: Since the fund manager has the flexibility to reduce exposure to high-risk small-cap or mid-cap stocks during volatile periods, the overall risk can be controlled. Flexi Cap Mutual Funds often provide a more balanced risk-return profile compared to funds that are concentrated in a single market segment.

Significance in Mutual Fund Landscape

Significance in Diversification: One of the key advantages of flexi-cap funds is their inherent diversification. By investing across companies of different sizes and industries, these funds spread risk more effectively than funds focused solely on a specific market cap. This diversification helps mitigate the impact of volatility in any particular segment, enhancing the overall stability of the portfolio.

Adaptability to Market Conditions: The constantly changing nature of financial markets requires an adaptable approach to investment strategies. Flexi-cap funds excel in this aspect by offering fund managers the freedom to adjust the allocation to different market caps based on prevailing economic conditions and market trends. During bullish phases, managers can tilt the portfolio towards mid and small-cap stocks to capture growth opportunities, while in bearish markets, they can shift towards larger, more stable companies.

Opportunities for Growth: Investors seeking a balance between growth and stability find flexi-cap funds attractive. These funds have the potential to deliver significant returns by capitalizing on the growth potential of mid and small-cap stocks, while also benefiting from the stability and established market presence of large-cap companies.

Risk Management: While flexi-cap funds provide growth potential, they also incorporate risk management strategies. The exposure of large-cap stocks provides stability, helping to reduce the impact of market downturns. While, exposure to mid and small-cap stocks adds capability of growth potential, striking a balance that suits investors with varying risk appetites.

Key Features of Flexi-Cap Funds

It focuses on three critical aspects: Portfolio Composition, Historical Performance and Fund Manager Expertise.

- Portfolio Composition: One of the defining characteristics of flexi-cap funds is their ability to invest across companies of varying market capitalizations – large-cap, mid-cap, and small-cap. This flexibility allows fund managers to navigate changing market conditions and capitalize on opportunities at different levels of the market. Also, diversification in these funds not only safeguards against adverse market movements but also enhances the potential for stable returns.

- Historical Performance/Consistent Growth: A track record of consistent growth across various market conditions is indicative of a well-managed flexi-cap fund. Investors should assess how the fund has performed during bull markets, bear markets, and periods of economic volatility.

- Historical Performance/Risk-Adjusted Returns: Evaluating the risk-adjusted returns of a flexi-cap fund helps investors understand how efficiently the fund has managed risk in relation to the returns generated. Funds that exhibit a favorable risk-return profile are generally considered more attractive. Comparison of 10 years’ average CAGR return between Flexi Cap Funds (return: 18.95%) and Large Cap Funds (17.51%) also shows higher returns for Flexi Cap category, however both categories have majority of investments in Large Cap stocks.

- Fund Manager’s Analytical Skills: Given the diverse nature of flexi-cap portfolios, fund managers must possess strong analytical skills to evaluate companies across market capitalizations. Thorough reasearch and analysis are essential to identify opportunities for growth and manage risks effectively.

- Fund Manager’s Asset Allocation Expertise: Effective asset alllocation is a key determinant of a flexi-cap fund success. Fund managers with a keen understanding of market trends and economic indicators can strategically allocate assets to maximize returns while mitigating potential downsides.

Difference between Flexi Cap and Multi Cap Mutual Funds

Flexi Cap Mutual Fund

Flexibility in Allocation: Fund managers have complete flexibility to invest across any market capitalization without restrictions. They can change the allocation between large-cap, mid-cap, and small-cap stocks as they see fit based on market conditions and opportunities.

Dynamic Portfolio: Since the allocation isn’t fixed, the fund manager can shift investments based on market trends and performance, aiming for better risk-adjusted returns.

Multi Cap Mutual Fund

Defined Allocation: SEBI mandates that multi-cap funds must invest a minimum of 25% of their assets in each of the three segments: large-cap, mid-cap, and small-cap stocks. This ensures a more balanced exposure to different market capitalizations.

Fixed Exposure: The fund manager has less flexibility compared to a flexi-cap fund due to the regulated minimum allocation to each market cap segment, which can result in higher exposure to small-cap stocks.

Key Differences:

Flexibility: Flexi-cap funds are more flexible, while multi-cap funds have fixed minimum exposure to all market caps.

Risk: Multi-cap funds may carry more risk due to their mandated exposure to small-cap stocks, while flexi-cap funds can reduce risk by allocating more to large-cap stocks during volatile periods.

In summary, Flexi Cap funds offer more flexibility, while Multi Cap funds follow a structured allocation across all market caps.

Who Should Invest in Flexi Cap Mutual Funds

Flexi Cap Mutual Funds are ideal for investors who:

- Seek diversification across different market segments.

- Want the flexibility to benefit from multiple market opportunities.

- Have a moderate to high-risk tolerance and a long-term investment horizon.

- Prefer to rely on professional fund management to navigate market volatility.

Considerations for Investors

A. Risk Tolerance Assessment: Risk tolerance refers to an investor’s ability to endure fluctuations in the value of their investments without making hasty decisions. Flexi-cap funds, by design, invest in companies across the market capitalization spectrum, including large-cap, mid-cap, and small-cap stocks. As such, these funds can exhibit varying levels of volatility.

Understanding your risk tolerance is crucial in selecting the right flexi-cap fund that aligns with your comfort level and financial objectives.

B. Investment Horizon: These funds are well-suited for investors with a long-term perspective, as they provide exposure to companies with varying growth trajectories. While large-cap stocks may offer stability, mid-cap and small-cap stocks have the potential for higher growth but come with increased volatility.

If you have a longer investment horizon, you may be better positioned to withstand short-term market fluctuations and benefit from the compounding effect of returns over time.

C. Financial Goals Alignment: Before investing in flexi-cap funds, it’s crucial to align your investment strategy with your financial goals. Different investors have varying objectives, such as wealth accumulation, funding education, or planning for retirement.

Investors should assess whether the risk and return characteristics of flexi-cap funds complement their specific financial objectives. For instance, if your goal is capital appreciation with a long-term perspective, a flexi-cap fund may be well-suited. However, if your goal is capital preservation or generating income, you might need to explore other investment options that align more closely with those objectives.

Best Flexi Cap Mutual Funds

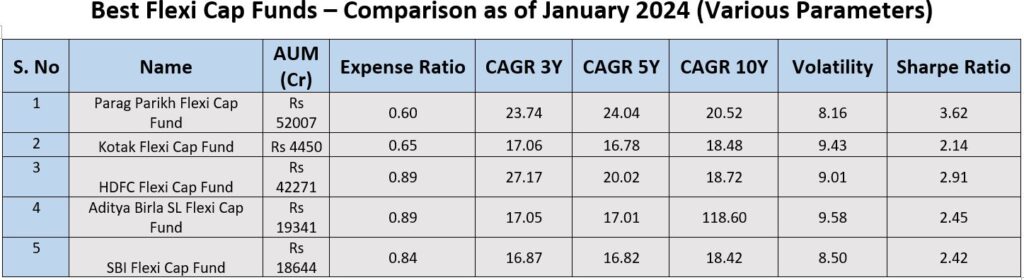

As of March 19, 2024, there were 34 flexi cap mutual funds in India. These funds are open-ended dynamic equity schemes that invest in large, mid, and small cap stocks. As per category regulations it is mandatory to invest 65% of funds allocation in Equity, for these funds. Based on analysis including AUM, returns, rolling returns, Alpha, Beta, Sharpe ratio, Turnover Ratio, Expense ratio etc., 05 funds found suitable for investments in Flexi Cap Fund category.

- Parag Parikh Flexi Cap Fund:

Date Of Allocation: May 24, 2013.

Fund Managers: Mr. Rajeev Thakkar and Mr. Rukun Tarachandani (Domestic Equity), Raunak Onkar manages the foreign investment component. Raj Mehta is responsible for the ‘fixed income’ investment component.

Click here to invest in Parag Parikh Flexi Cap Fund

- HDFC Flexi Cap Fund:

Date Of Allocation: January 01, 1995.

Fund Managers: Ms. Roshi Jain (Equities) and Mr. Dhruv Muchhal (Equity Analyst and Fund Manager for Overseas Investments)

Click here to invest in HDFC Flexi Cap Fund

- Kotak Flexi Cap Fund:

Date Of Allocation: September 11, 2009.

Fund Managers: Mr. Harsha Upadhyaya.

Click here to invest in Kotak Flexi Cap Fund

- SBI Flexi Cap Fund:

Date Of Allocation: January 01, 2013.

Fund Managers: Mr. R Srinivasan and Mr. Pradeep Kesavan.

Click here to invest in SBI Flexi Cap Fund

- Aditya Birla Sun Life Flexi Cap Fund:

Date Of Allocation: January 01, 2013.

Fund Managers: Mr. Dhaval Joshi and Mr. Harish Krishnan

Click here to invest in Aditya Birla Sun Life Flexi Cap Fund

Below is the detailed comparison of these 05 Flexi Cap funds against various parameters such as AUM, Expense Ratio, CAGR (3yesr, 5year and 10year), volatility and Sharpe Ratio for further assessment.

Disclaimer: This analysis and above fund suggestion is merely for educational and informational purpose. Do consider a financial analyst opinion prior to taking decision for fund allocation in any of Flexi Cap funds.

Frequently Asked Questions

Q1. Is a flexi-cap fund suitable for long-term investors?

Flexi-cap funds, constitute a segment of equity investments, hence are appropriate for all long-term investors. People looking for capital appreciation at a time horizon of more than 05 years should invest in flexi-cap funds.

Q2. Which is a better choice, mid-cap or flexi-cap mutual fund?

Flexi-cap funds are generally more diversified than mid-cap funds, as they have a freedom to invest in more stocks. However, based on investment goal choice of selection differs.

Q3. Are Flexi-cap mutual funds a good investment?

As name suggests, due to portfolio diversification (having large, mid and small cap), flexi-cap funds stands suitable for new investors as they try to keep minimum risk within equity.

Q4. Who should invest in flexi-cap funds?

Individuals aimed to stand invested for a longer duration of time should consider investing in flexi cap funds. As flexi-caps spend at least 65% of their assets in Equities (Large, mid and small cap category), therefore high risk tolerant, long duration investors only should invest in these funds.

Q5. Is a Flexi-cap mutual fund better than Multi-cap?

Flexi-cap funds provide a more flexible approach in investing into companies of different sizes, further giving a mixture of stability and growth. They are seen to provide more flexibility to the fund managers to optimize risk adjusted returns. Hence, Flexi Cap Fund provides more option for asset allocation flexibility.

Disclaimer: The above analysis and review is only for study and informatinal purpose, Mutual Fund investments are subject to market risks, use your own analysis and read all scheme-related documents carefully before investing.

References

Conclusion

Flexi Cap Mutual Funds offer a dynamic and flexible approach to equity investing. Their ability to invest across different market capitalizations makes them a versatile option for investors seeking long-term growth, diversification, and risk management. With professional fund managers adjusting portfolios based on market conditions, these funds have the potential to provide balanced and optimal returns over time.

However, with any investment, it’s important to assess your financial goals, risk tolerance, and investment horizon before making a decision. Flexi Cap funds can be an excellent addition to a diversified portfolio, helping you achieve financial goals in a balanced and dynamic way. Last but not the least, with any investment, consulting with a financial advisor is recommended to tailor your investment strategy to your unique circumstances and goals.

Hope this blog, “WHAT ARE FLEXI CAP FUNDS: TOP 05 FLEXI CAP FUNDS IN 2024” will be of good information and use in your navigation about Flexi Cap Mutual Funds and related investments.