In the dynamic landscape of the financial market, investors are constantly seeking avenues that offer both growth and diversification. One such investment instrument gaining prominence is the Multi-Cap Fund. This innovative investment vehicle provides investors with a unique blend of characteristics, diverse portfolio allocation, and flexibility in market capitalization. In this blog, “WHAT ARE MULTI CAP FUNDS? TOP 04 MULTI CAP FUNDS IN INDIA” we’ll explore about their characteristics, benefits and best funds available.

Understanding Multi-Cap Funds

Definition and Characteristics:

Multi-cap funds are a category of mutual funds that invest in stocks across different market capitalizations, including large-cap, mid-cap, and small-cap stocks. The allocation to each category may vary based on market conditions and the fund manager’s strategy. This flexibility allows multi-cap funds to adapt to changing market dynamics and capitalize on opportunities across the spectrum. However, rule dated 11th Sep 2020 mandates, all the Multi-cap funds to invest minimum of 25% of their portfolio in each market capitalization category (large, mid, and small-cap companies adding to 75%).

Characteristics of Multi-Cap Funds:

Diversification: One of the key features of Multi-Cap Funds is their ability to offer diversification across market segments. By investing in companies of different sizes, these funds spread risk and minimize the impact of underperformance in any single segment. This diversification is crucial in managing volatility and providing stability to the overall portfolio.

The allocation is not fixed and can be adjusted based on the fund manager’s outlook and prevailing market conditions. This flexibility allows investors to benefit from the growth potential of smaller companies while maintaining exposure to the stability offered by larger, more established firms.

Risk-Return Tradeoff: Multi-Cap Funds strike a balance between risk and return. Large-cap stocks offer stability and lower risk, while mid-cap and small-cap stocks have the potential for higher returns but come with increased volatility. The fund manager’s expertise in allocating assets across these segments is pivotal in optimizing the risk-return tradeoff.

Adaptability to Market Conditions: Multi-Cap Funds showcase adaptability to changing market conditions. In times of bullish trends, the fund can tilt towards mid and small-cap stocks to capture higher returns. Conversely, during market corrections or uncertainties, the fund manager may shift focus towards large-cap stocks for stability. This dynamic approach enhances the fund’s resilience across market cycles.

Flexibility In Market Capitilization

Seizing Opportunities: Multi-Cap Funds possess the agility to seize opportunities across the market spectrum. Whether it’s identifying a promising small-cap stock with high growth potential or investing in a large-cap company with a robust track record, the fund can capitalize on diverse opportunities that align with its investment objectives.

Risk Management: The flexibility in market capitalization enables Multi-Cap Funds to actively manage risk. In volatile market conditions, the fund manager may allocate a higher percentage to large-cap stocks to cushion against potential downturns. Conversely, in a bullish market, a tilt towards mid and small-cap stocks may enhance returns.

Significance in Mutual Fund Landscape

Significance in Diversification: One of the key advantages of multi-cap funds is their inherent diversification. By investing across companies of different sizes and industries, these funds spread risk more effectively than funds focused solely on a specific market cap. This diversification helps mitigate the impact of volatility in any particular segment, enhancing the overall stability of the portfolio.

Adaptability to Market Conditions: The dynamic nature of financial markets requires a flexible approach to investment strategies. Multi-cap funds excel in this aspect by offering fund managers the freedom to adjust the allocation to different market caps based on prevailing economic conditions and market trends. During bullish phases, managers can tilt the portfolio towards mid and small-cap stocks to capture growth opportunities, while in bearish markets, they can shift towards larger, more stable companies.

Opportunities for Growth: Investors seeking a balance between growth and stability find multi-cap funds attractive. These funds have the potential to deliver significant returns by capitalizing on the growth potential of mid and small-cap stocks, while also benefiting from the stability and established market presence of large-cap companies.

Risk Management: While multi-cap funds provide growth potential, they also incorporate risk management strategies. The combination of large-cap stocks provides stability, helping to cushion the impact of market downturns. At the same time, exposure to mid and small-cap stocks adds an element of growth potential, striking a balance that suits investors with varying risk appetites.

Key Features of Multi-Cap Funds

Portfolio Composition

One of the defining characteristics of multi-cap funds is their ability to invest across companies of varying market capitalizations – large-cap, mid-cap, and small-cap. This flexibility allows fund managers to navigate changing market conditions and capitalize on opportunities at different levels of the market. Also, diversification in these funds not only safeguards against adverse market movements but also enhances the potential for stable returns.

Fund Manager Expertise

Analytical Skills: Given the diverse nature of multi-cap portfolios, fund managers must possess strong analytical skills to evaluate companies across market capitalizations. Thorough research and analysis are essential to identify opportunities for growth and manage risks effectively.

Asset Allocation Expertise: Effective asset allocation is a key determinant of a multi-cap fund’s success. Fund managers with a keen understanding of market trends and economic indicators can strategically allocate assets to maximize returns while mitigating potential downsides.

Historical Performance

Consistent Growth: A track record of consistent growth across various market conditions is indicative of a well-managed multi-cap fund. Investors should assess how the fund has performed during bull markets, bear markets, and periods of economic volatility.

Risk-Adjusted Returns: Evaluating the risk-adjusted returns of a multi-cap fund helps investors understand how efficiently the fund has managed risk in relation to the returns generated. Funds that exhibit a favorable risk-return profile are generally considered more attractive.

Advantages of Multi-Cap Funds

Diversification: Multi-cap funds provide investors with a diversified portfolio by including companies of various sizes. This diversification helps spread risk and reduces the impact of poor performance in any single segment of the market.

Flexibility and Adaptability: Fund managers of multi-cap funds have the flexibility to shift allocations among large-cap, mid-cap, and small-cap stocks based on their assessment of market conditions. This adaptability allows them to capitalize on emerging trends and adjust the portfolio to optimize returns.

Risk Management: By investing across market capitalizations, multi-cap funds mitigate the risk associated with relying solely on a specific segment of the market. Large-cap stocks may provide stability, while mid-cap and small-cap stocks offer growth potential, creating a balanced risk profile.

Capitalizing on Market Opportunities: Multi-cap funds are positioned to seize opportunities across the entire market. In bullish markets, they can benefit from the growth of mid and small-cap stocks, while in bearish markets, the stability of large-cap stocks can cushion the impact.

Long-Term Growth Potential: With the ability to invest in companies of different sizes, multi-cap funds can tap into the diverse growth trajectories of various sectors. This long-term perspective aligns well with investors aiming for sustained wealth creation.

Professional Management: Investors benefit from the expertise of fund managers who actively manage the portfolio, making investment decisions based on thorough research and analysis. This professional management can potentially outperform passive investment strategies over the long term.

Considerations for Investors

Risk Tolerance Assessment

Risk tolerance refers to an investor’s ability to endure fluctuations in the value of their investments without making hasty decisions. Multi-cap funds, by design, invest in companies across the market capitalization spectrum, including large-cap, mid-cap, and small-cap stocks. As such, these funds can exhibit varying levels of volatility.

Understanding your risk tolerance is crucial in selecting the right multi-cap fund that aligns with your comfort level and financial objectives.

Investment Horizon

These funds are well-suited for investors with a long-term perspective, as they provide exposure to companies with varying growth trajectories. While large-cap stocks may offer stability, mid-cap and small-cap stocks have the potential for higher growth but come with increased volatility.

If you have a longer investment horizon, you may be better positioned to withstand short-term market fluctuations and benefit from the compounding effect of returns over time.

Financial Goals Alignment

Before investing in multi-cap funds, it’s crucial to align your investment strategy with your financial goals. Different investors have varying objectives, such as wealth accumulation, funding education, or planning for retirement.

Investors should assess whether the risk and return characteristics of multi-cap funds complement their specific financial objectives. For instance, if your goal is capital appreciation with a long-term perspective, a multi-cap fund may be well-suited. However, if your goal is capital preservation or generating income, you might need to explore other investment options that align more closely with those objectives.

Real Time Case Studies

Examining Noteworthy Performances

SBI Magnum Multi-Cap Fund: The SBI Magnum Multi-Cap Fund stands out as a noteworthy performer in the Indian market. By strategically allocating investments across large-cap, mid-cap, and small-cap stocks, the fund has demonstrated resilience in different market conditions. Its ability to identify growth opportunities, coupled with a robust risk management strategy, has contributed to consistent and impressive returns (Absolute Returns, XIRR & CAGR) over the years.

Invest in SBI Magnum Multi Cap Fund

Mirae Asset India Equity Fund: The Mirae Asset India Equity Fund is another success story that showcases the potential of multi-cap funds in the Indian market. The fund’s focus on quality stocks across market capitalizations has resulted in commendable performance. It highlights the importance of a research-driven approach and the ability to adapt to changing market dynamics, underscoring the significance of active fund management.

Funds Case Studies

Case Study 1: Mahindra Manulife Multi Cap Fund Direct – Growth: This Fund has consistently delivered robust performances over the past five years. The fund manager strategically allocated assets among large-cap, mid-cap, and small-cap stocks based on market conditions. In 2020-21, when the market witnessed significant volatility due to the global economic uncertainties, Mahindra Manulife Multi Cap Fund Direct – Growth demonstrated resilience.

The fund manager navigated through the challenging market conditions by shifting allocations towards market defensive sectors, which proved to be prudent. This approach shielded the fund from the worst of the market downturn, ensuring that investors experienced relatively lower losses compared to broader market indices.

Case Study 2: Nippon India Multi Cap Fund Direct – Growth: This fund stands out for its consistent outperformance in both bull and bear markets. The fund’s success can be attributed to its active management strategy and thorough research process. The fund manager employed a bottom-up approach, carefully selecting individual stocks based on their fundamental strengths and growth prospects.

During the bull market, Nippon India Multi Cap Fund capitalized on the momentum by overweighting its portfolio towards mid-cap stocks with high growth potential. As the market dynamics changed in the subsequent years, the fund’s flexibility allowed it to pivot towards large-cap stocks, providing stability and capital preservation during volatile periods.

Case Study 3: Quant Active Fund Direct – Growth, momentum investing Fund: Quant Active fund follows a unique approach by dynamically adjusting its asset allocation based on prevailing market conditions, following trend, mean reversion, statistical arbitrage, algorithmic pattern recognition, and sentiment analysis. The fund’s asset allocation ranges from predominantly large-cap holdings in bullish phases to increased exposure in mid and small caps during market corrections.

In 2020, amid the economic uncertainties triggered by the global pandemic, Quant Active Fund swiftly reduced its exposure to riskier assets, preserving capital for investors. As the market rebounded in 2021, the fund tactically increased allocations to mid and small caps, capturing the growth potential in sectors that benefited from the economic recovery.

Lessons Learned from Historical Trends

Sectoral Rotation Strategies: Historical trends in Indian multi-cap funds emphasize the effectiveness of sectoral rotation strategies. Successful funds have demonstrated the ability to reallocate investments based on changing economic conditions and sectoral trends. This flexibility allows funds to capitalize on emerging opportunities and navigate through market uncertainties, showcasing the importance of staying dynamic in the ever-evolving Indian market.

Diversification as a Risk Management Tool: By spreading investments across sectors and market capitalizations, these funds can mitigate risks associated with sector-specific downturns. This approach has proven instrumental in providing stability to the overall portfolio, even during challenging market phases.

Long-Term Perspective and Investor Education: Multi-cap funds’ success stories in India also highlight the significance of maintaining a long-term perspective and investor education. Funds that have consistently delivered positive returns over the years have often encouraged investors to stay invested for the long haul. Educating investors about the potential benefits of multi-cap funds and the importance of patience in wealth creation has played a crucial role in fostering trust and loyalty.

How to Choose the Right Multi-Cap Fund

Research and Analysis

Understand Your Financial Goals: Before delving into the world of Multi-Cap funds, it’s essential to define your financial goals. Whether you’re looking for long-term wealth creation, income generation, or a balanced approach, aligning your goals with the fund’s objectives is crucial.

Risk Tolerance: Assess your risk tolerance level to determine the appropriate allocation to equities in your portfolio. Multi-Cap funds, by nature, can vary in risk profiles, and selecting one that aligns with your risk appetite is imperative.

Performance History: Evaluate the historical performance of the Multi-Cap funds you are considering. Look for consistent returns over various market cycles. Platforms like Morningstar, Value Research, and others provide valuable insights into fund performance.

Portfolio Composition: Analyze the fund’s portfolio composition to ensure it aligns with your investment strategy. Diversification across sectors and market caps can help mitigate risks. Understand the top holdings and sectors the fund is exposed to.

Fund Manager Track Record

Experience and Expertise: Assess the experience and expertise of the fund manager. A seasoned manager with a proven track record is more likely to navigate the dynamic market conditions effectively.

Consistency in Performance: Look for fund managers who have consistently delivered positive returns over the long term. Consistency is a key indicator of a manager’s ability to navigate various market scenarios.

Managerial Changes: Be wary of frequent managerial changes. A stable and experienced fund management team provides continuity and enhances the fund’s stability.

Fund Expenses and Fees

Expense Ratio: The expense ratio represents the annual cost of managing the fund as a percentage of its assets. Lower expense ratios are generally more favorable for investors, as they result in higher net returns.

Exit Load: Check the fund’s exit load, which is a fee charged when investors redeem their units. Understanding exit loads is crucial, especially if you have a specific investment horizon in mind.

Hidden Costs: In addition to the expense ratio, be aware of any hidden costs associated with the fund. Transaction costs, brokerage fees, and other charges can impact your overall returns.

Best Multi Cap Funds Available In India

At present in India, majorly 19 Actively managed multi cap funds are available for investments. As per category regulations it is mandatory to invest 25% of funds allocation in each Large Cap, Mid Cap and Small Cap stocks. In this blog, “What are Multi Cap Funds? Top 04 Multi Cap Funds In India”, we will perform a review of available Multi Cap funds options available in India.

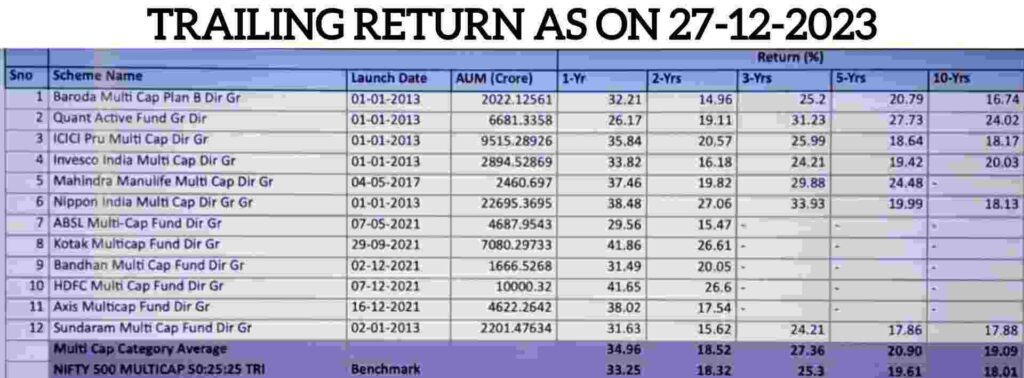

In order to evaluate available Multi Cap funds a detailed analysis has been done considering their date of inception, Asset Under Management and Returns in different time horizons.

Below given is a detailed comparison of available main Multi cap funds with returns in comparison to category average returns and respective bench mark return.

Based upon evaluating overall returns, rolling returns through a period of 05 years, Alpha, Beta, Sharpe ratio, Turnover Ratio, Expense ratio etc., 04 funds found suitable for investments in Multi Cap Fund category. These funds are:

1. Quant Active Fund Direct Growth

2. Nippon Active Multi Cap Fund Direct Growth

3. Mahindra Manulife Multi Cap Fund Direct Growth

4. ICICI Prudent Multi Cap Fund Direct Growth

Below mentioned are the top 04 funds in Multi Cap fund category to invest in India with their return comparison.

For the ease of understanding below mentioned is a detailed analysis done for all major Multi Cap Funds available in India considering parameters like Overall returns, Asset Allocation, P/E Ratio, Top sectors of investment, Alpha, Beta, Sharpe ratio, Turnover Ratio and Expense ratio.

From the analysis done it is clear that Multi Cap Funds are highly risky investments therefore investors should consider all the parameters along with their risk apetite prior to selecting Multi Cap Funds.

For Aggressive Investor: Quant Active Fund Direct Growth

For Moderate Investor: Nippon India Multi Cap Direct Growth

Conservative Investor should avoid investing in Multi Cap Fund category, as multi cap category is riskier due to compulsion of investment (25%) in each cap (large, mid and small cap) category.

Disclaimer: This analysis and above fund suggestion is merely for educational and informational purpose. Do consider a financial analyst opinion prior to taking decision for fund allocation in any of Multi Cap funds.

Frequently Asked Questions

Q1. Is a multi-cap fund suitable for long-term investors?

Multi-cap funds, constitute a segment of equity investments, hence are appropriate for all long-term investors. People looking for capital appreciation at a time horizon of more than 05 years should invest in multi-cap funds.

Q2. Which is a better choice, mid-cap or multi-cap mutual fund?

Multi-cap funds are generally more diversified than mid-cap funds, as they have a freedom to invest in more stocks. However, based on investment goal choice of selection differs.

Q3. Are multi-cap mutual funds a good investment?

As name suggests, due to portfolio diversification (having large, mid and small cap), multi-cap funds stands suitable for new investors as they try to keep minimum risk within equity.

Q4. Who should invest in multi-cap funds?

Individuals aimed to stand invested for a longer duration of time should consider investing in Multi cap funds. As multi-caps spend at least 50% of their assets in mid and small cap category, and in the long term, mid and small caps seen beating large caps.

Q5. Is a multi-cap mutual fund better than Flexi-cap?

Multi-cap funds provide a more balanced approach in investing into companies of different sizes, further giving a mixture of stability and growth. They are seen to be more diversified across sectors and market capitalizations. On the other hand, Flexi Cap Fund provides option for asset allocation flexibility.

Disclaimer: Mutual Fund investments are subject to market risks, read all scheme-related documents carefully.

Additional Resources

Conclusion

Multi-cap funds stand out as a dynamic investment option, offering investors a well-rounded approach to wealth creation. The unique combination of diversified portfolio composition, fund manager expertise, and historical performance make these funds a compelling choice for those looking to navigate the ever-evolving landscape of the financial markets.

With their ability to adapt to market conditions, diversify risk, and strategically allocate across market capitalizations, these funds present an attractive proposition. Investors looking for a balanced blend of stability and growth potential should consider incorporating Multi-Cap Funds into their investment strategy, unlocking the doors to a diversified and resilient portfolio. Investing in multi-cap funds can be a strategic choice for investors seeking diversification across market capitalizations.

However, success in the world of mutual funds requires careful consideration of your risk tolerance, investment horizon, and alignment with financial goals. By thoroughly evaluating these factors, investors can make informed decisions that support their long-term financial well-being. As with any investment, consulting with a financial advisor is recommended to tailor your investment strategy to your unique circumstances and goals.

Hope this blog, “What are Multi Cap Funds? Top 04 Multi Cap Funds In India” will suffice its purpose of sharing knowledge.