What is Inflation?

Inflation is an important term which frequently comes in headlines, influencing economies and impacting financial measures worldwide. It refers to the sustained increase in the general price level of goods and services over a period of time, leading to a decrease in the purchasing power of a currency. In this blog, “What is Inflation: Cost inflation index & Consumer price Index” we will delve into the various facets of inflation, exploring its types, the factors influencing it, and two essential indices used to measure its impact: The Cost Inflation Index (CII) and the Consumer Price Index (CPI).

Types of Inflation

Demand-Pull Inflation: Occurs when aggregate demand surpasses aggregate supply, leading to an increase in prices. Common causes include increased consumer spending, government expenditure, or investment.

Cost-Push Inflation: This type of inflation emerges from increasing production costs, for example, increase in income, raw materials price increase, and/or supply chain disruptions. These kind of changes often results in higher unemployment rates and reduced production.

Built-In Inflation (Wage-Price Inflation): Rooted in a self-sustaining cycle where increased prices lead to demands for higher wages, and higher wages lead to increased production costs. Can create a continuous loop of rising prices and wages.

Hyperinflation: An extremely high and typically accelerating inflation rate, often exceeding 50% per month. This usually results by a collapse in the value of the currency of a country because of factors like excessive money printing or political instability.

Factors Contributing to Inflation in India

Supply and Demand Imbalances: One of the primary factors influencing inflation in India is the imbalance between supply and demand. Rapid economic growth, coupled with population expansion, can create situations where demand outstrips supply, leading to price increases.

Rising Fuel and Commodity Prices: Indian economy primarily depends on imported oil and commodities. Fluctuations in global oil prices and commodity markets can significantly impact inflation. Sudden increases in these prices can escalate production and transportation costs, leading to higher prices for goods and services.

Monetary Policy and Interest Rates: In India, The Reserve Bank of India (RBI) is the key player and play an important role in controlling inflation through implementing monetary policy. If interest rates are too low, it may lead to increased borrowing, higher spending, and inflationary pressures. On the other hand, extremely high interest rates may choke the economic growth.

Fiscal Policies: Government spending and taxation policies also contribute to inflation. An expansionary fiscal policy, involving increased government spending and reduced taxes, can stimulate demand but may lead to inflation if not carefully managed.

Exchange Rate Movements: Currency depletion/devaluation can impact inflation by making goods that are imported more expensive. As India is an import-dependent economy, fluctuations in exchange rates can affect the overall price level.

Steps Taken to Contain Inflation

Monetary Policy Measures: The Reserve Bank of India employs various monetary tools, such as adjusting interest rates and open market operations, to control money supply and inflation. By influencing borrowing costs, the RBI aims to moderate inflationary pressures.

Supply-Side Reforms: Adequate handling of supply-side restriction is crucial for inflation control. The government has undertaken initiatives to improve infrastructure, reduce logistics costs, and enhance agricultural productivity to ensure a steady supply of goods and services.

Fiscal Prudence: The government adopts prudent fiscal policies to strike a balance between growth and inflation. Preparing adequate fiscal management, with extreme attention to deficits and public debt, helps to maintain an overall economic stability. Assessing the nexus between fiscal policy, COVID-19, and economic growth.

Strategic Stockpiling and Imports: To counteract supply shocks, strategic stockpiling of essential commodities and facilitating imports during shortages are strategies employed by the government to stabilize prices and prevent hoarding.

Enhancing Agricultural Productivity: Being an agriculture dominant country, agriculture is one of the important contributor in the Indian economy. By applying policies that promote adoption of technology, irrigation facilities and implementing good farming practices can increase agricultural productivity, alongwith conforming a stable food supply and mitigating inflationary pressures.

Inflation management is an important part for any economy. Recognizing the multifaceted nature of inflation, the government and central bank have implemented a combination of monetary, fiscal, and supply-side measures. It is crucial to continuously monitor economic indicators and adjust policies as needed to ensure that inflation remains within a sustainable range, fostering economic growth and stability.

Unraveling the Impact: How Inflation Shapes Economies and Lives

Economic Impacts:

- Purchasing Power Erosion: Inflation significantly reduces the purchasing power of a currency, reducing the value of money over time. As prices rise, consumers find themselves needing more money to buy the same goods and services, leading to a reduction in their standard of living.

- Interest Rates and Investments: Central banks often respond to inflation by adjusting interest rates. Higher interest rates can discourage borrowing and spending, affecting investments and economic growth. On the other hand, lower interest rates may stimulate economic activity but may increase the inflation further.

- Income Redistribution: Inflation can impact income distribution. Limited income group, such as retired person which lives on pensions, can find it difficult to live previous lifestyle because their fixed income is losing real value.

Impact on Businesses:

- Costs and Profit Margins: Different businesses have to face increased input costs because the raw materials, labor prices, and other input costs rises. Maintaining profit margins becomes a delicate balancing act, and smaller businesses may find it particularly challenging to absorb these cost increases.

- Uncertainty and Planning: High inflation introduces uncertainty into the business environment. Long-term planning becomes more difficult as businesses grapple with volatile prices and uncertain market conditions.

Social and Individual Impacts:

- Income Inequality: Inflation can exacerbate income inequality. Those with substantial assets or investments may see their wealth grow, while individuals relying on fixed incomes or low wages may struggle to keep pace with rising living costs.

- Impact on Savers: With inflation periods, savers observes decline in the real value of their savings. This can discourage saving and impel spending, which leads to economic imbalances.

- Poverty and Vulnerable Groups: Vulnerable populations, such as those living in poverty, are disproportionately affected by inflation. Basic necessities become more expensive, placing an increased burden on those already struggling to make ends meet.

Government Responses:

- Monetary and Fiscal Policies: Governments often deploy monetary and fiscal policies to combat inflation. These measures may include adjusting interest rates, controlling money supply, and implementing fiscal policies aimed at stabilizing prices. For detailed analysis, read this blog written by,

“Indian School Of Public Policy”: Analyzing The Impact Of India’s Fiscal Policy On Economic Growth - Social Safety Nets: Governments may also strengthen social safety nets to protect vulnerable groups from the adverse effects of inflation. Implementations like providing subsidies and initiatives for public welfare aims to reduce the impact on the effected ones.

How Inflation Influences Taxation Across Asset Classes in India

One area where impact of inflation is keenly felt is taxation, especially concerning different asset classes. India, being a big and divergent economy, it is important to understand the complex relationship between inflation and taxation. This is crucial for investors as well as policymakers.

Equity Investments: Equity investments (such as Stocks and Mutual Funds) are often considered a hedge against inflation. However, equity gains are also not immune to the effects of rising prices. In India, long-term capital gains (LTCG) taxation is applicable on the sale of equity shares which are held for more than one year. The introduction of the LTCG tax in 2018 at a rate of 10% has impacted investors, and when adjusted for inflation, it can significantly reduce the real returns on equity investments.

The government’s calculation of LTCG considers the acquisition cost as the higher of the actual purchase price or the fair market value as of January 31, 2018. As inflation erodes the real value of money, investors may find themselves paying tax on gains that, in real terms, might not be as substantial.

Real Estate: Real estate, a traditional avenue for wealth creation, is also subject to the influence of inflation on taxation. In India, both short-term and long-term capital gains tax apply to property transactions. Short-term gains are taxed at the individual’s applicable income tax rate, while long-term gains are taxed at a flat rate of 20%.

Inflation’s impact on real estate is twofold. Firstly, it affects the actual value of the property, potentially leading to higher nominal gains. Secondly, the flat tax rate on long-term gains does not decrease the property’s real value over time due to inflation. Investors must consider these factors when assessing the after-tax returns from real estate investments.

Fixed Income Instruments: Bonds and fixed deposits are directly affected by inflation. With rise in prices, the actual returns on these fixed income investments can decrease. According to Indian taxation rules, interest income generated from fixed deposits is taxable (individual’s tax slab), and the taxation can reduce the real gains, especially during high inflation duration.

Further, inflation-linked bonds, though are designed to provide shelter against incresing prices, may still have tax involvements. One need to be careful with respect to the taxation of interest income and capital gains on such bonds with increasing ininflation.

Gold: Gold, often considered a hedge against inflation, attracts unique tax considerations in India. Within gold, taxation is applicable on gains on physical gold held for more than three years, however, gold exchange-traded funds (ETFs) and sovereign gold bonds (SGBs) have tax benefits.

Investors should be mindful of the impact of inflation on the real value of gold gains and the corresponding tax implications. A proper skilled approach is required to understand the relation between the rise in gold prices with inflation and their taxation.

Demystifying Key Indexes of Inflation: Understanding CII, CPI, and More

To measure and track inflation, various key indexes play a crucial role. Cost Inflation Index (CII) and Consumer Price Index (CPI) are the majorly used indexes out of them.

Cost Inflation Index (CII):

The Cost Inflation Index is a measure used to adjust the purchase price of an asset for inflation, helping calculate the capital gains tax. It considers the changes in inflation over the years, to assure proper taxation on the actual gains made by an individual.

Cost Inflation Index (CII) is an important parameter of taxation, particularly in countries like India. It plays a pivotal role in determining the inflation-adjusted acquisition cost of assets and thereby influences the capital gains tax liability.

What is Cost Inflation Index? : Cost Inflation Index is a measure used to adjust the purchase price of an asset for inflation over time. The primary purpose of CII is to factor in the impact of inflation when calculating the capital gains arising from the sale of an asset. In simple terms, it helps in arriving at the ‘indexed cost of acquisition’ by considering the inflationary changes in the economy.

Importance of Cost Inflation Index: Capital Gains Calculation: The indexed cost of acquisition is subtracted from the selling price to calculate the capital gains. This ensures that the impact of inflation is neutralized, providing a more accurate reflection of the actual gain.

Fair Taxation: Without indexation, individuals may have to pay taxes on gains that are because of inflation rather than actual profit. CII ensures fair taxation by including the depletion in the purchasing power of money.

Encourages Investments: Through Indexation benefit long-term investments gets encouraged by reducing the tax burden on gains. This is particularly relevant for assets held for extended periods.

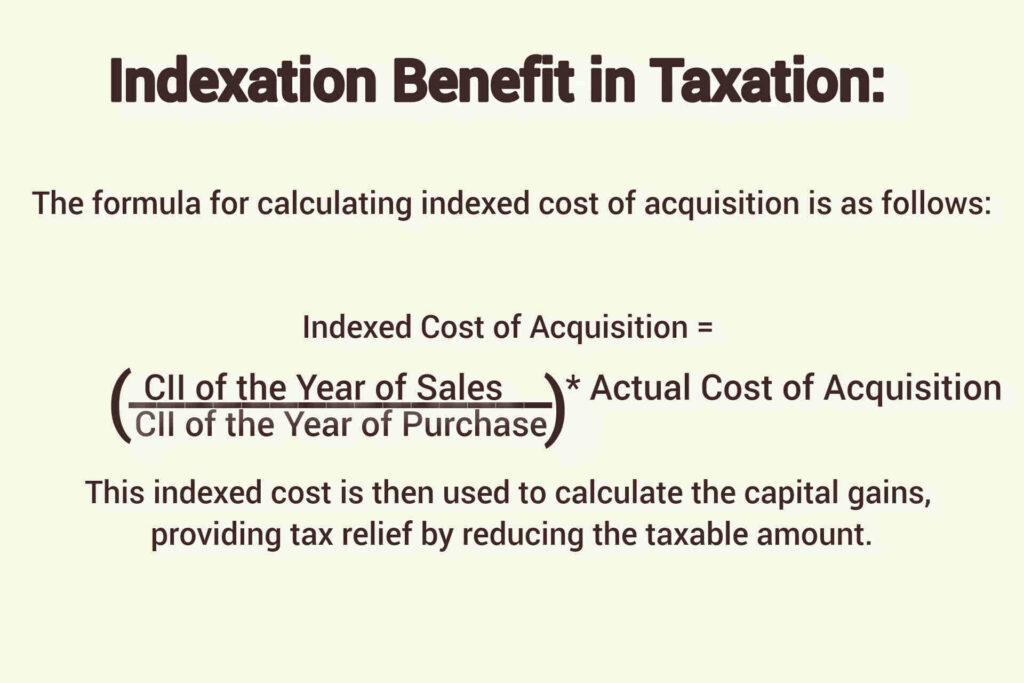

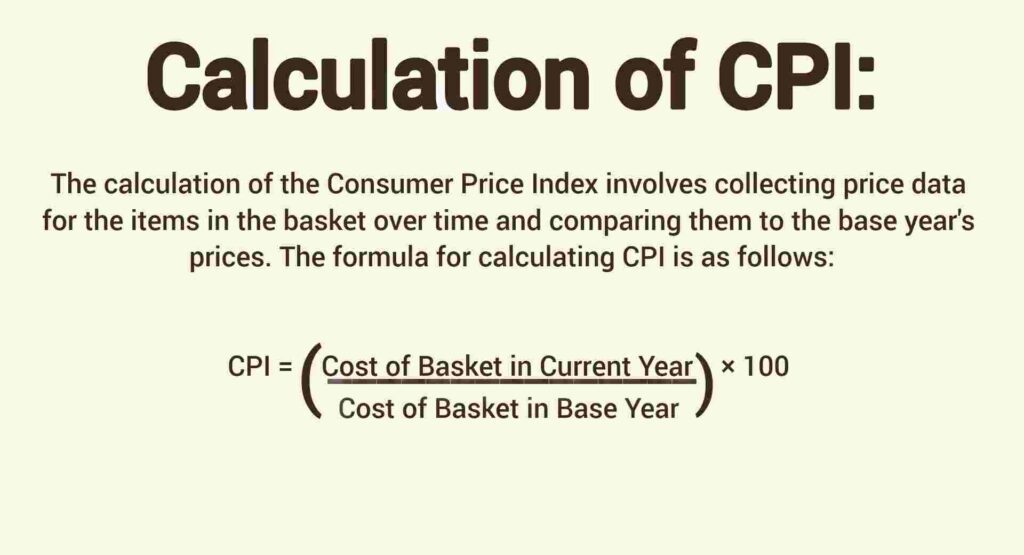

Indexation Benefit in Taxation: The formula for calculating indexed cost of acquisition is as follows:

This indexed cost is then used to calculate the capital gains, providing tax relief by reducing the taxable amount.

The formula for calculating CII is as follows:

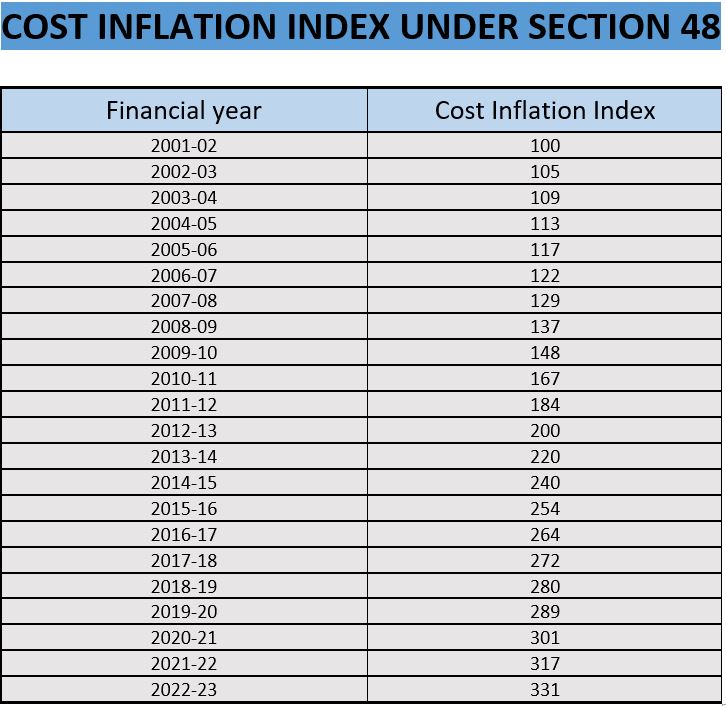

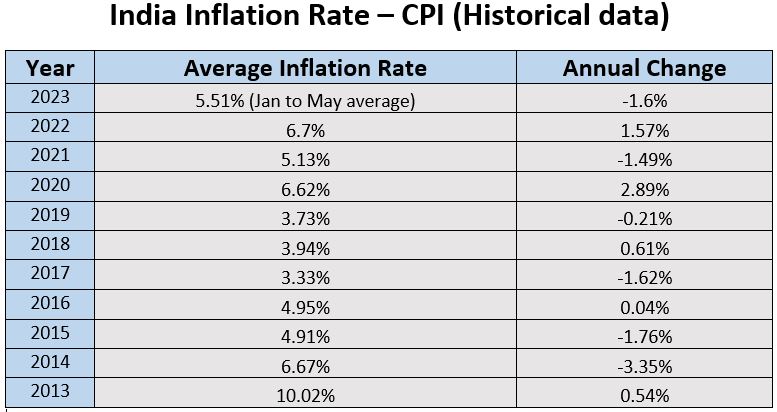

Last 10 Years Trend of Cost Inflation Index in India:

Let’s take a glance at the trends in Cost Inflation Index in India over the last decade:

The trend clearly shows a steady increase in the Cost Inflation Index, reflecting the impact of inflation on asset values. As the CII rises, the indexed cost of acquisition also increases, providing taxpayers with indexation benefits.

Cost Inflation Index is an important key for taxpayers, ensuring that they will be taxed on real gains irrespective of gains inflated by the decreasing value of money. Understanding the importance of CII and implementing indexation benefits can impact the tax liability on capital gains. Keeping an eye on the trends in CII helps taxpayers make informed decisions regarding the timing of asset sales. In the dynamic landscape of taxation, keeping well informed with such concepts is essential for financial planning and effective wealth management.

Consumer Price Index (CPI):

The Consumer Price Index measures the average change in prices paid by consumers for goods and services over time. It is a crucial indicator of inflation, reflecting the cost of living and helping individuals and policymakers make informed economic decisions. Components of the CPI typically include food, housing, transportation, and medical care.

Understanding the Consumer Price Index and Its Significance in the Indian Perspective

The Consumer Price Index (CPI) is an important indicator which is uded to measure inflation and establishing the consumers purchasing power. In India, CPI is of upmost importance, as it gives a reflection of the cost of living, regulates decisions related to monetary policy and hence impacts the lives of indian people.

The Consumer Price Index is a statistical measure that gauges the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. Items such as food, clothing, rent, healthcare, and other everyday expenses are the main constituents of this basket. The CPI is expressed as an index number relative to a base year, which is assigned the value of 100. Subsequent index values reflect the percentage change in prices compared to the base year.

For detailed information, do review this detailed analysis by World Bank: Inflation Consumer prices (Annual %) – India

Calculation of CPI:

Significance of CPI in the Indian Perspective:

Inflation Measurement: Inflation is the rate at which the normal level of prices for goods and services is rises. In India, inflation is a critical economic factor that directly affects consumers’ purchasing power, savings, and overall economic stability. The main role of CPI is to measure inflation.

Monetary Policy Decision-Making: Central banks, including the Reserve Bank of India (RBI), use CPI data to formulate and implement monetary policies. By understanding the inflation rate, policymakers can make informed decisions about interest rates and money supply, aiming to maintain price stability and sustainable economic growth.

Cost of Living Index: CPI serves as a cost of living index, reflecting the changes in the average cost of goods and services consumed by households. This information is invaluable for individuals, businesses, and policymakers in assessing the impact of inflation on daily life and planning for the future.

Wage Adjustments: Many labor contracts and government programs are linked to inflation rates as measured by the CPI. Workers often negotiate wage increases based on the cost of living, and social welfare benefits may be adjusted to account for changes in prices.

Policy Formulation and Planning: Governments use CPI data to formulate various policies, including fiscal and social policies. It helps in understanding the economic challenges and opportunities, enabling policymakers to develop strategies that promote inclusive and sustainable growth.

With respect to India, in which a diverse population is bound to face varying economic conditions, CPI is of upmost importance. Policymakers, businesses, and individuals alike rely on CPI data to navigate the dynamic economic landscape and ensure a stable and prosperous future.

Other key Indexes:

Other Key Indexes: Apart from CII and CPI, many other key indexes are also in existence which helps in comprehensive understanding of inflation:

Producer Price Index (PPI): PPI is defined as the index which analyzes/estimates the average change over time in the selling prices received by domestic producers for their output. It provides insights into inflationary pressures at the producer level.

Personal Consumption Expenditures Price Index (PCE): The Personal Consumption Expenditures Price Index is another key metric used to assess inflation. It goes beyond the traditional consumer basket considered in the CPI and includes a broader range of goods and services. The PCE is the preferred inflation gauge for the U.S. Federal Reserve, as it provides a more comprehensive view of consumption patterns.

Mainly there are two components in which PCE is divided : PCE for goods and PCE for services. This breakdown helps analysts understand which sectors of the economy are contributing most to changes in overall prices.

Wholesale Price Index (WPI): Similar to PPI, WPI measures the average change in the selling prices received by wholesalers. It indicates the change in cost in the wholesale stage of production.

Core Inflation: Core inflation is an indicator which separates certain volatile elements from the overall inflation calculation. Typically, it excludes food and energy prices, which can be subject to significant short-term fluctuations. By these core components, experts try to identify hidden trends in inflation and distinguish between temporary and persistent factors.

Many banks generally consider core inflation while devicing monetary policy, as core inflation provides a more suitable and reliable picture of long-term inflationary pressures.

GDP Deflator : It reflects the overall price change in the entire economy. This is generally calculated by ratio of nominal GDP to real GDP, which gives an elaborative view of inflationary trends.

Below is an informative video embeded for the ease of understanding:

Strategies to Mitigate Inflation's Impact

Invest Wisely: One of the most effective ways to hedge against inflation is through strategic investments. This can be done by keeping a portion of portfolio into the assets which traditionally outperform during inflationary periods. For Example tools such as Stocks, Mutual Funds, real estate, and commodities (gold) are those investments that have historically held their value and/or appreciated with rise in inflation.

Diversification is Key: One can reduce risk and enhance resilience of their portfolio by diversifying the investments across different asset classes . While certain investments may suffer in the face of inflation, others may thrive. By diversifying, you can offset potential losses in one area with gains in another, helping to safeguard your overall financial health.

Invest in Real Assets: Real estate and commodities are some examples of real assets, which have historically shown to be effective hedges against inflation. Real estate values often appreciate during inflationary periods, and commodities like gold and silver tend to retain value because they are tangible assets. When the cost of goods and services rises, Investing in real assets can help preserve your wealth.

Consider TIPS (Treasury Inflation-Protected Securities): TIPS are a type of government bond specifically designed to protect against inflation. These securities adjust their principal value based on changes in the Consumer Price Index (CPI). By investing in TIPS, you ensure that the purchasing power of your money keeps pace with inflation, providing a reliable hedge against rising prices.

Optimize Debt Management: Inflation erodes the real value of debt, making it advantageous for borrowers. If you have existing fixed-rate loans, the real value of your debt decreases as prices rise. However, variable-rate debt can become more expensive, so it’s crucial to evaluate your debt portfolio and consider restructuring if necessary.

Focus on Income-Generating Assets: Assets that generate a steady source of income, such as stocks which pay dividend or rental properties, can be some of smart investment tools in inflationary periods. Regular income generated from these tools can help reduce the impact of rising prices and provide a more stable financial foundation.

Stay Informed and Adjust: Being in continuously changing economic conditions, it is of upmost importance to stay informed for making informed financial decisions. One should regularly review their investment strategy and adjust it according to prevailing economic trends. Keeping ourself up-to-date of inflation prediction, interest rates, and market dynamics allows us to proactively respond to changing conditions.

Build Emergency Savings: Inflation can bring unexpected financial challenges. Having a robust emergency fund in place can provide a financial safety net during uncertain times. Ensure your emergency savings are easily accessible and can cover essential living expenses for several months.

Additional links

https://www.statista.com/statistics/271322/inflation-rate-in-india/

https://incometaxindia.gov.in/tutorials/15-%20ltcg.pdf

https://www.statista.com/statistics/276322/monthly-inflation-rate-in-india/

https://tradingeconomics.com/india/food-inflation

6 Modeling and Forecasting Inflation in India: https://www.elibrary.imf.org/display/book/9781557759924/ch006.xml

Prices and Inflation: (https://www.indiabudget.gov.in/budget2021-22/economicsurvey/doc/vol2chapter/echap05_vol2.pdf)

Consumer Price Index Manual: (cpi-manual-concepts-and-methods.pdf) : https://en.wikipedia.org/wiki/Inflation

Frequently Asked Questions

What is the difference between CPI and CII?

The main difference between Consumer Price Index and Cost Iinflation Index is the treatment of assets prices. The CII considers the increase in the price of goods and services included in the CPI along with asset prices; whereas, the CPI doesn? Instead CPI include the capital gains or the increase in the price of assets over time.

Is CPI called inflation?

CPI is an index used to measure inflation in India. CPI measures retail inflation by collecting data for prices of goods and services that are being consumed by the retail population.

For more queries click the link below:

https://www.oecd.org/sdd/prices-ppp/consumerpriceindices-frequentlyaskedquestionsfaqs.htm

Conclusion

Hence, to conclude, Inflation refers to the sustained increase in the general price level of goods and services in an economy over a period of time. Inflation is a dynamic force that shapes the economic landscape and influences the daily lives of individuals. It is typically measured as an annual percentage change in the Consumer Price Index (CPI) or the Producer Price Index (PPI). Inflation depletes the purchasing power of a currency, as with the passing time, same amount of money buys fewer goods and services.

While moderate inflation is considered a normal part of a healthy economy, hyperinflation or deflation can have severe economic consequences. Central banks, such as the RBI in India, the Federal Reserve in the United States, implies tools such as monetary policy to manage inflation and strive for price stability.

Factors contributing to inflation include increased demand, supply shocks, and changes in production costs, making it a complex phenomenon that requires careful economic analysis and policy consideration.

However, staying informed and taking adequate steps such as investing in inflation proof Assets can mitigate inflation effects and provide hedge against Inflation.

Good informative post… keep it up

Thanks a lot for your valuable feedback. Please keep on exploring our other blogs also.