Brief overview of investment strategies:

Investing is a nuanced art that involves navigating through various strategies to achieve financial goals. Two prominent approaches to investing are growth investing and value investing. In this blog, “Which is best – Growth vs Value vs Mixed Approach?”, we will explore the key concepts of growth and value investing, blend of two investing styles, their characteristics, and the factors investors consider when implementing these strategies.

These strategies, while distinct in their principles, share the common goal of maximizing returns.

Growth Investing: Growth investing revolves around identifying companies with the potential for substantial expansion in the future. Investors following this strategy focus on companies that demonstrate robust earnings growth, often at a faster rate than the overall market. These companies are typically at the forefront of innovation, operating in industries with promising prospects.

The allure of growth investing lies in the potential for significant capital appreciation. As these companies continue to expand, their stock prices may rise accordingly, offering investors the opportunity for substantial returns. However, it’s important to note that growth stocks can be more volatile, as their valuations may be based more on future potential than current earnings.

Thomas Rowe Price Jr. is known as the father of growth investing.

Key Characteristics of Growth Investing:

High Growth Potential: Growth investors seek companies with above-average growth rates in revenue, earnings, and cash flow. These companies often operate in burgeoning industries and possess innovative products or services.

Limited Concern for Valuation: Growth investors are generally willing to pay a premium for stocks of companies expected to grow significantly. Valuation metrics such as price-to-earnings ratios may be higher compared to value stocks.

Focus on Future Potential: The primary consideration for growth investors is the future potential of a company. They believe that the market will eventually recognize and reward the company’s growth, leading to capital appreciation.

Focus on companies with high potential for future earnings growth: Growth investing is to invest in Growth stocks. The companies expected to grow their sales and earnings at a more rate than the market average are called Growth stocks. Trading at a high P/E ratio, growth stocks often seems to be expensive, but if the company continues to grow rapidly by which the share price goes up, such valuations could actually be cheap.

Growth stocks typically don’t pay dividends. If those expectations were not get fulfilled and since investors are paying a high price for those growth stock, based on expectation, growth stocks can see dramatic downfall.

Examples of growth stocks: Some Indian growth stocks include Bajaj Finance, Varun Beverages, Avenue Supermart, Titan Company ltd etc.

Value Investing: Value investing, on the other hand, is rooted in the idea of identifying stocks that are undervalued relative to their intrinsic worth. Investors employing this strategy look for companies with solid fundamentals—such as low price-to-earnings ratios, strong balance sheets, and consistent dividends—that the market may have overlooked.

Value investing style was developed by Benjamin Graham, who is known as the father of value investing. It came in existence about 100 years ago. Another popular investor Warren Buffet, one of the wealthiest persons of the world, also follows the principles of Value investing.

Value investing provides a more conservative approach compared to growth investing. By focusing on established companies with stable financials, value investors seek to capitalize on the market’s tendency to eventually recognize and correct undervalued stocks. This strategy is often associated with a “buy-and-hold” mentality, emphasizing a patient, long-term approach to investing.

Key Characteristics of Value Investing:

Emphasis on Intrinsic Value: Value investors analyze fundamental factors such as earnings, dividends, and book value to determine a stock’s intrinsic value. They aim to buy stocks trading below this intrinsic value.

Margin of Safety: Value investors prioritize a margin of safety, which is the difference between a stock’s intrinsic value and its market price. This provides a buffer against potential market fluctuations and errors in valuation.

Patience and Contrarian Thinking: Value investing requires patience, as it may take time for the market to recognize the true value of a stock. Value investors often exhibit contrarian thinking, being willing to go against prevailing market sentiment.

Focus on undervalued stocks with strong fundamentals: Value investing invests in Value stocks (shares of companies with good quality fundamentals and decent growth prospects). However, because of some reasons these stocks can be undervalued by the market in the short term. This undervaluation makes value stocks very attractive for long-term investors. If purchased in sufficient quantities at the right price, these stocks can deliver very high returns.

Due to negative market sentiment, sometimes, the price of a stock falls below its intrinsic value. At such times it can trade at a discount to its peers or the industry average. This is an example of an undervalued stock. Valuations tools like the commonly used Price to Earnings and Price to Book ratios can help one find a good value stock that is trading at a discount to its historical valuations.

Examples of value stocks: Some Indian value stocks include Coal India Ltd, ONGC, Coalgate Palmolive (India) Ltd etc.

Pros & Cons of Growth and Value Investing

Pros of Growth Investing:

High Return Potential: The primary allure of growth investing lies in its potential for substantial returns. By selecting stocks of companies with strong growth prospects, investors aim to capitalize on the appreciation of share prices over time.

Innovation and Momentum: Growth stocks often belong to innovative companies operating in industries with high growth potential. Investing in such companies allows investors to ride the wave of technological advancements and market trends, potentially leading to outsized gains.

Attractive to Young Investors: Growth investing tends to appeal to younger investors with a longer investment horizon. The strategy aligns well with those looking to accumulate wealth over time, taking advantage of compounding returns.

Market Leadership: Companies identified for growth investing are often industry leaders with strong competitive advantages. Investing in such companies can provide a sense of security and stability in the long run.

Diversification Benefits: Including growth stocks in a diversified portfolio can enhance risk-adjusted returns. While growth stocks may be more volatile, a well-diversified portfolio can help mitigate risk.

Cons of Growth Investing:

Higher Volatility: Growth stocks are known for their higher volatility compared to more stable value stocks. Rapid price fluctuations can lead to increased market risk and potential short-term losses.

Uncertain Earnings: Companies with high growth potential may not always translate that potential into consistent earnings. Investors may face challenges in accurately predicting future earnings, making it difficult to assess the true value of a growth stock.

Valuation Concerns: Growth stocks are often priced at a premium due to high market expectations. This can result in elevated valuation ratios, making it crucial for investors to carefully evaluate whether the anticipated growth justifies the current stock price.

Market Sentiment Dependency: Growth stocks can be highly sensitive to market sentiment and macroeconomic factors. Economic downturns or shifts in investor sentiment can impact the performance of growth stocks, leading to sudden declines.

Overlooking Fundamentals: In the pursuit of growth, investors may overlook fundamental indicators such as earnings quality and financial stability. Neglecting these factors can expose investors to risks, especially during economic downturns.

Pros of Value Investing:

Long-Term Focus: Value investing encourages a patient, long-term approach. Investors are less swayed by short-term market fluctuations and focus on the intrinsic value of a stock, fostering a disciplined investment mindset.

Historical Success: Numerous successful investors, including Warren Buffett, have built their fortunes on value investing. This strategy has proven to be effective over time, creating a sense of reliability for those who follow its principles.

Margin of Safety: Value investing emphasizes the concept of a “margin of safety.” By purchasing undervalued stocks, investors aim to protect themselves from significant losses in case of market downturns or unexpected events.

Dividend Income: Many value stocks are established, financially stable companies that pay regular dividends. This can provide a steady income stream for investors, especially those seeking a reliable source of passive income.

Contrarian Approach: Value investing often involves going against market trends. This contrarian approach can lead to opportunities for investors to buy stocks at lower prices when the market sentiment is negative.

Cons of Value Investing:

Lack of Short-Term Gains: Value investing is not a strategy for those seeking quick profits. The undervalued stocks identified may take time to reflect their true value, requiring patience and a long investment horizon.

Market Inefficiencies: The success of value investing relies on the market being inefficient in pricing stocks. In today’s highly information-driven markets, finding consistently undervalued stocks can be challenging, as information is quickly reflected in stock prices.

Psychological Challenges: Value investing can be emotionally demanding. Enduring periods of underperformance or seeing other stocks surge can test the resolve of investors. Staying committed to the long-term strategy despite short-term setbacks can be mentally challenging.

Limited Exposure to Growth Stocks: Value investing tends to focus on mature, stable companies. This approach may result in missing out on opportunities presented by high-growth, but potentially overvalued, stocks.

Uncertain Timing: Identifying the perfect time to buy undervalued stocks is challenging. Investors might struggle to time their entry into the market, leading to missed opportunities or purchasing stocks that continue to decline.

Valuation Considerations in Growth Investing vs. Value Investing

Investors often find themselves at a crossroads when deciding on an investment strategy. Growth investing is a strategy that focuses on companies with strong potential for above-average earnings growth. Investors in growth stocks are typically attracted to companies demonstrating robust revenue growth, high-profit margins, and a compelling competitive advantage.

Valuation in growth investing often involves looking beyond traditional metrics like price-to-earnings (P/E) ratios, as growth stocks may not have substantial current earnings but are expected to deliver significant earnings in the future.

Value investing, on the other hand, revolves around identifying undervalued stocks trading below their intrinsic value. Investors following this strategy seek companies with strong fundamentals but are temporarily out of favor, leading to lower stock prices. Valuation in value investing often involves traditional metrics like P/E ratios and dividend yields.

Key Valuation Considerations in Growth Investing:

Price-to-Earnings Growth (PEG) Ratio: Unlike value investors who may prioritize low P/E ratios, growth investors often use the PEG ratio. This ratio factors in a company’s expected earnings growth rate, providing a more comprehensive view of valuation. A PEG ratio below 1 is generally considered favorable for growth stocks.

Discounted Cash Flow (DCF) Analysis: Growth investors frequently employ DCF analysis to estimate the present value of a company’s future cash flows. By discounting these cash flows back to their current value, investors can assess whether the stock is undervalued based on its growth potential.

Comparative Analysis: Growth investors often compare a company’s growth metrics with industry peers and market benchmarks. Metrics such as revenue growth, earnings growth, and market share gains can provide insights into a company’s competitive position and growth potential.

Key Valuation Considerations in Value Investing:

Price-to-Earnings (P/E) Ratio: A fundamental metric in value investing, the P/E ratio compares a company’s current stock price to its earnings per share. A low P/E ratio is often indicative of an undervalued stock, making it an attractive prospect for value investors.

Dividend Yield: Value investors often favor stocks with a history of paying dividends. Dividend yield, calculated by dividing the annual dividend per share by the stock price, provides insight into the income generated by the investment. A higher dividend yield can be appealing to value investors seeking income.

Book Value: Value investors frequently assess a company’s book value, which is the difference between its assets and liabilities. Stocks trading below their book value may be considered undervalued, attracting value investors looking for bargains.

Performance Comparison – Growth Stocks vs. Value Stocks

From long back, the performance of growth and value stocks is a topic of extensive debate among the known experts of stock market, favoring their investment strategy.

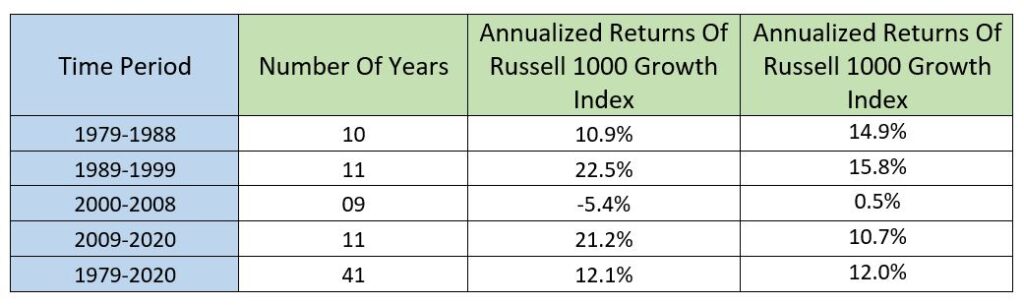

But it is seen that, these value stocks and growth stocks performance are quite often found cyclical in nature. Below mentioned is a comparison of the annual returns of US-based Russell 1000 Growth Index and the Russell 1000 Value Index on an extended time period:

During 1989-1999 and 2009-2020 periods, the Russell 1000 Growth Index secured annual returns of over 20%. Similarly, the Russell 1000 Value Index has beaten the growth index during 1979-1988 and between 2000-2008. This analysis indicates that the preference for value investments and growth investments keep on changing every 10 years or so.

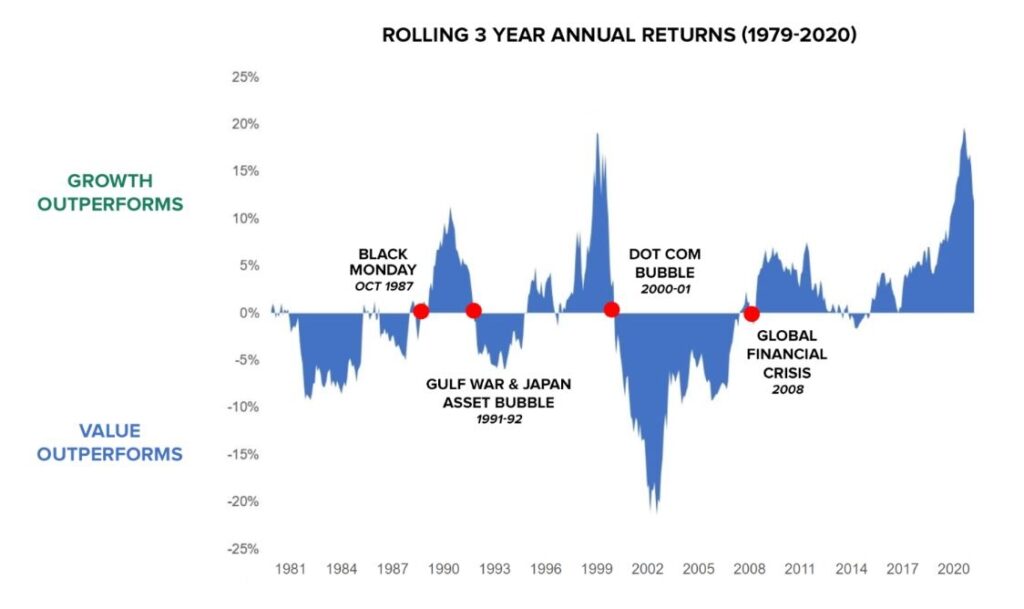

Below mentioned is the data of the same indices over shorter periods based on 3-year rolling returns of the indices to get a clear picture:

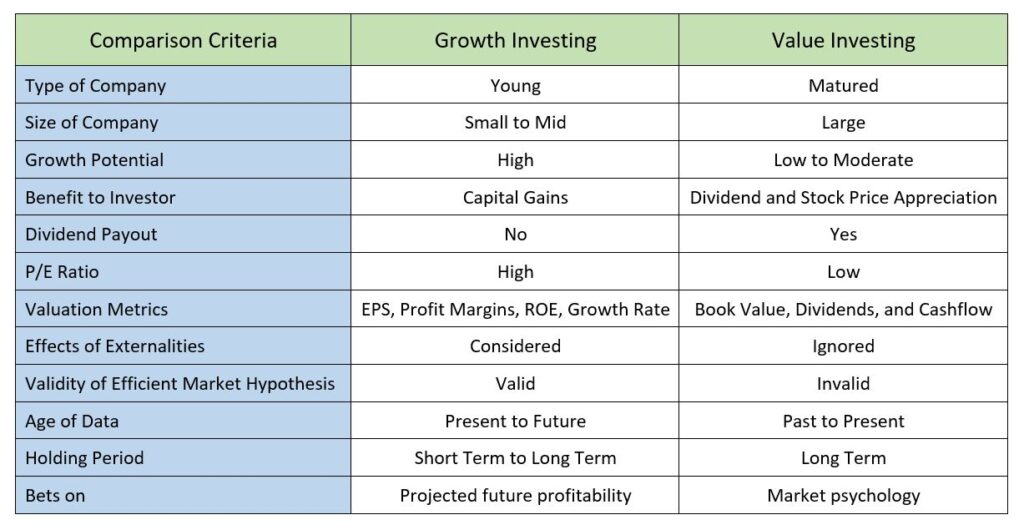

Both of these growth and value investing offer some opportunities, objectives, assessments, and drawbacks to investors, as mentioned below in table:

Blend: Mitigating Volatility & Maximizing returns

From the above information, it is clear that both stategies have its merits and de-merits. However, in combination they mitigate the de-merits of each other, alongwith providing stability to the portfolio against market volatility and maximizes returns in all market cycles.

Now a days in market, so many Mutual Fund options are available that provides oppurtunity of blend approach, giving your portfolio benefit of Growth and stability with sustainable returns.

Diversification as a risk management strategy

One of the primary benefits of combining growth and value investments is diversification. By holding a mix of both types of securities, investors can spread their risk across different market segments. During market downturns, growth stocks may experience declines, but value stocks might remain more stable or even rise.

Conversely, during market upswings, growth stocks can provide significant returns, while value stocks offer a cushion against potential overvaluation risks.

Risk Mitigation: Both growth and value stocks come with their own sets of risks. Growth stocks can be more volatile due to higher valuations and heightened market expectations. On the other hand, value stocks may carry the risk of prolonged undervaluation. By blending these two styles, investors can balance the risks and potentially minimize the overall volatility of their portfolio.

Market Cycle Resilience: Markets go through cycles of expansion and contraction. Growth stocks tend to outperform during economic expansions, while value stocks may shine during contractions. A well-diversified portfolio that includes both growth and value investments is better equipped to weather the different phases of the market cycle, ensuring a more consistent performance over the long term.

Growth and value complement each other in a mixed portfolio

Opportunity for Capital Appreciation and Income: Growth stocks offer the potential for significant capital appreciation over time, while value stocks may provide more stable income through dividends. Combining these two investment styles allows investors to benefit from both capital appreciation and income generation, catering to different financial goals and preferences.

Incorporating a mix of growth and value stocks or mutual funds in your investment portfolio can be a prudent strategy for mitigating volatility and achieving more stable long-term returns. The synergistic relationship between these two investment styles provides diversification benefits, risk mitigation, and resilience across various market conditions.

By carefully balancing the growth and value components of your portfolio, you can navigate the unpredictable nature of the stock market with greater confidence and potentially enhance your overall investment success.

Below is an informative video embeded for your reference:

Risks and Challenges

Acknowledging potential drawbacks of combining growth and value

Divergent Objectives:

Growth vs. Value: Growth stocks are typically associated with higher volatility and lower dividends, as investors are banking on future appreciation. On the other hand, value stocks often appeal to those seeking stability and income through dividends. Combining these two strategies may create conflicting objectives within a portfolio, posing challenges in achieving a cohesive investment strategy.

Market Timing Difficulties:

Cyclical Nature: Growth and value stocks tend to perform differently during various market cycles. Timing the market to capture the benefits of both strategies can be challenging. A portfolio manager needs to be adept at recognizing shifts in market conditions to adjust the allocation between growth and value stocks effectively.

Risk Management:

Concentration Risk: Balancing growth and value stocks requires a keen eye on diversification. Over-concentration in one style over the other could expose the portfolio to unnecessary risk. Managing this concentration risk becomes crucial to prevent large losses in case one segment of the portfolio underperforms.

Information Overload:

Analytical Complexity: Investors combining growth and value strategies may find themselves juggling an extensive array of financial metrics, market indicators, and company data. Analyzing this vast amount of information can be overwhelming and may lead to decision paralysis or suboptimal choices.

Strategies for managing risks in a blended portfolio

Diversification: Maintain a well-diversified portfolio across sectors, industries, and market capitalizations to reduce concentration risk. This ensures that the performance of one segment does not unduly impact the overall portfolio.

Dynamic Asset Allocation: Regularly reassess the market conditions and adjust the allocation between growth and value stocks accordingly. This dynamic approach helps capitalize on opportunities presented by different market cycles.

Thorough Research: Conduct in-depth fundamental analysis to identify stocks that possess both growth potential and solid value characteristics. This requires a comprehensive understanding of a company’s financial health, competitive positioning, and growth prospects.

Risk-Adjusted Returns: Evaluate investment opportunities based on risk-adjusted returns rather than absolute returns. This approach allows investors to assess the potential rewards in relation to the level of risk undertaken, aiding in better decision-making.

Long-Term Perspective: Adopt a long-term investment horizon when combining growth and value strategies. Short-term market fluctuations may obscure the benefits of a balanced approach. Patience is key to realizing the full potential of both growth and value investments.

Pitfalls to Avoid:

Both value and growth investing have their merits, but investors must navigate the pitfalls associated with each strategy. By conducting thorough fundamental analysis, diversifying effectively, staying attuned to market trends, timing investments wisely, and resisting the urge to overreact to short-term volatility, investors can enhance their chances of building a resilient and profitable portfolio.

Remember, successful investing requires a balanced approach that combines the best elements of both value and growth strategies.

Overlooking Fundamental Analysis:

Growth Investing Pitfall: Focusing solely on anticipated growth without assessing the company’s current financial position can result in investing in overvalued stocks.

Value Investing Pitfall: Relying solely on low valuation metrics without considering the underlying fundamentals can lead to investments in companies with weak financial health.

Ignoring Diversification:

Growth Investing Pitfall: Investing too heavily in high-growth stocks can make a portfolio susceptible to market volatility, as these stocks may be more sensitive to economic downturns.

Value Investing Pitfall: Overconcentration in a specific sector or industry can expose investors to significant risks if that sector underperforms.

Neglecting Market Trends:

Growth Investing Pitfall: Failing to adapt to changing market conditions may lead to holding onto growth stocks that have lost momentum.

Value Investing Pitfall: Ignoring broader market trends can result in value stocks remaining undervalued for an extended period.

Underestimating the Importance of Timing:

Growth Investing Pitfall: Entering the market late in a growth stock’s cycle can expose investors to the risk of buying at inflated prices.

Value Investing Pitfall: Buying undervalued stocks too early may lead to missed opportunities for capital appreciation.

Overreacting to Short-Term Market Volatility:

Growth Investing Pitfall: Panic selling during market downturns may cause investors to miss out on potential recoveries.

Value Investing Pitfall: Selling undervalued stocks in response to short-term market fluctuations can result in missed long-term gains.

GARP Investing

GARP investing, (growth at a reasonable price investing), is based on balancing growth against high valuations. In GARP investing investor seeks out for growth companies that are priced in line intrinsic value. GARP investors address future growth related uncertainties by using PEG ratio to check whether a company is fairly priced as per its growth prospects. PEG ratio is calculated by dividing the P/E ratio by company’s expected growth rate.

Stock is considered fairly priced if the result is indicated of one or less. On the other hand, result above one indicates that the stock is very expensive.

GARP stategy got popularized by the well not investor Peter Lynch. “One Up On Wall Street”.

Frequently Asked Questions

What are Growth and Value Investing?

In Stock market growth and Value Investing are two major kinds of investing. Growth investing is based on investing in companies that have high growth potential going forward in the future, while Value investing identifies the companies which are undervalued in market but have the potential to rise in value.

Which investing style is better, Growth or Value?

It totally depends on investment goals and risk tolerance. Growth investing can offer high returns but it is more riskier as requires investing in those companies which are in their growth stage. Value investing, on the contrary, considered to be safer option as it involves investing in already established companies, but may offer lower returns.

Which sectors are best for Growth vs Value investing?

Growth investing generally found associated with sectors like technology, healthcare, and consumer discretionary, while Value investing is found associated with sectors such as financials, energy, and utility. However, performance of these sectors depends on the economic and market conditions.

How do I choose between Growth and Value stocks?

Analysis of parameters like company’s financial health, market trends, and growth potential decides whether a stock is Growth or Value. It is always better to consult a financial advisor or have a thorough research before making any investment decisions.

Conclusion

It is clear from above detailed analysis that based on risk profile, investment duration and goal/money requirement investing methodology changes. Both growth and value investing brings money appreciation to your portfolio. However, prior to choosing any of these investing style one must understand the pros and cons of these investing styles.

It is also very clear that creating a blend of these two styles brings stability (mitigates market volatility) and maximizes return (irrespective of different market cycles). In the ever-changing landscape of financial markets, finding the right balance between growth and value investing is paramount.

A well-diversified portfolio that incorporates elements of both strategies can provide investors with the stability, resilience, and optimal returns needed to achieve their financial goals. By understanding the importance of this delicate balance, investors can orchestrate a symphony of investments that stands the test of time.

Hope this blog, “Which is Best – Growth vs Value vs Mixed Approach?”, will be of good use and will provide the required information for solving the Dilemma related to investing styles.